What are Virtual Cards and Why Should Your Team Use Them?

by The Ottimate Editorial Team

Are you still slogging through hours of manual payment processing and expense reporting? If so, you know how time-consuming, error prone, and less-than-secure the process can be. Luckily, there’s a better way — one that’s faster, more secure, and offers you greater convenience and control over your payments: using virtual cards.

By leveraging the power of virtual cards, you can spend less time paying invoices, tracking expenses, and worrying about security, and more time on the work that matters most to your business.

Let’s break down what virtual cards are and how they can benefit you and your team.

What is a virtual card?

A virtual card (or vCard) is a randomly-generated single- or multi-use credit card number that’s linked to your credit card account. vCards are generated for specific amounts, which can be used for any type of online payment — from online store purchases to bill and invoice payments.

Virtual cards are very safe to use and offer greater protection than a traditional, physical credit card. This is because once it’s been processed, a vCard number can’t be re-used — keeping hackers away from your account and preventing overspending.

How do virtual cards work?

Let’s say you’re making an online purchase. As you go through the checkout process, you get to the payment screen.

Rather than pull out your physical credit card and enter its details, there’s another, more secure option: using a one-time-use virtual card.

A vCard has all the information you need to submit your payment, including a 16-digit payment number, expiration date, and security code. The card’s number is linked to your credit card account and operates the same way your physical card does. You simply enter the virtual card details, the transaction processes, and the charge posts to your account.

Unlike your physical credit card, a virtual card can only be used for specific, designated transactions, giving you complete control over the amount spent. Once it’s been “swiped,” the number on your vCard can never be used again.

This means that even if a hacker somehow got hold of your vCard number, they wouldn’t be able to do anything with it. No need to call your bank, file a claim, get a new card mailed, or any of the hassle faced when your physical card is compromised.

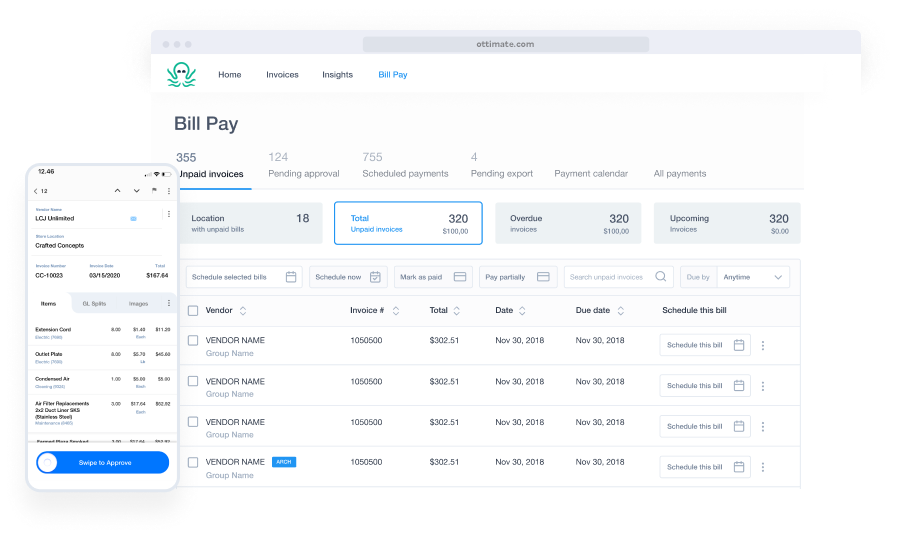

Virtual cards can also be used for more than your online purchases — you can also use vCards to pay invoices and vendor fees. And with a payment automation solution like Ottimate, you can process your invoices, generate vCards, and pay your vendors — all from a single system. Talk about making payments easy!

6 reasons to use virtual cards

Virtual cards give you all the benefits of a physical credit card without the full risk. Let’s take a look at some of the key reasons to consider making vCards part of your payments process:

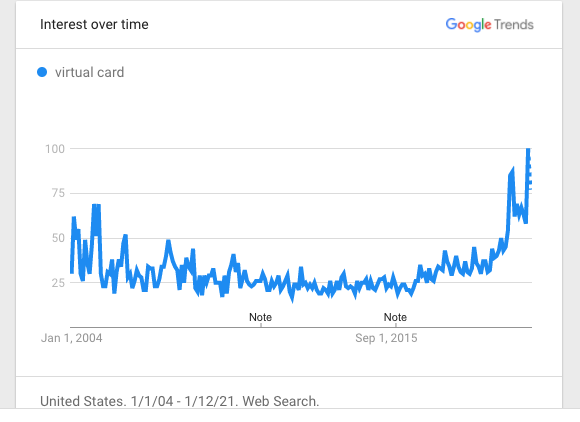

1. Virtual cards are widely accepted

This flexible, secure technology is already shaping up to be one of the most enduring payments innovations of the last decade. Interest in vCards has never been higher, and many banks, card issuers, and even financial software solutions (like Ottimate) offer ways to quickly and easily generate virtual cards when you need them.

And because many vendors now accept vCards, using one is as easy as swiping a physical credit card.

2. Virtual cards give you more control over cash flow

When you generate a vCard, you can adjust all the card’s parameters, including its expiration date, merchant category codes, and even the exact dollar amount it carries.

If anyone tries to swipe your vCard for a higher price or tack on additional charges, the card won’t go through. This helps you stay on top of pricing changes and extra expenses that may arise, so you and your team can make informed financial decisions before spending more than you’ve budgeted.

3. Virtual cards are more secure

Virtual cards add a powerful layer of protection between your card account and a would-be thief. By masking your actual account with a randomly-generated 16-digit vCard number, any fraudulent activity would be limited to whatever amount is attached to that vCard.

If a regular credit card number were compromised, you’d have to file a claim with your credit card company to protect your account, order and wait for new cards to arrive, and change every recurring payment attached to that card. Using a virtual card eliminates these steps, saving you time, effort, and hassle.

4. Virtual cards can help you control employee spend

vCards make tracking and controlling employee spending much simpler than regular credit cards. Instead of giving out a single card number to every employee, you can confidently issue a single-use virtual card to whoever needs it.

Using virtual cards also helps make it easier and more efficient for your employees to pay vendors for services or products. When employees use a company-issued vCard to pay invoices, payments are sent faster and more accurately than check or ACH payments.

5. Virtual cards can help you earn cashback

Many companies view virtual cards as a way to replace expense reports alongside their existing corporate card programs. This is because many vCards offer rewards programs, so you can earn cashback on every eligible transaction. Cashback can add up over time, which can make a significant difference to your bottom line — especially if you’re a small or midsize business.

For example, say you’re a restaurant that receives a $100,000 invoice each month from your produce supplier. If you pay them with a vCard that earns 1% cashback, you could be earning $1,000 in cashback that could be used towards operational expenses — including covering your monthly AP automation fees!

6. vCard payments are faster and more cost efficient

For many businesses, paying bills is synonymous with sending checks through the mail. If that sounds like you, consider how much goes into making sure every step of the process works.

First, there’s the time and cost of cutting and sending the check. You’ll need to pay for supplies, like check stock, envelopes, and postage. Your team then has to manually write the check, get it signed by the appropriate people, stuff and address an envelope to send it, and finally record it in your company’s accounting system.

Next, you’ll need to wait for the payment to reach your vendor and for your vendor to process and deposit your check — followed by the time it takes for the check to clear and funds to be transferred from your account to your vendor’s. Depending on your or your vendor’s workflows and bandwidth, this entire process can take several days to several weeks.

Virtual cards simplify the process — and make it a lot faster. vCard payments post almost immediately, and are automatically logged in your payment system. No more worrying about paying for supplies, the time it takes to cut, send, and deposit a check, or delayed payments from slow “snail mail” travel!

Start using vCards today with Ottimate

If the security, speed, and convenience of virtual cards is something your business has been thinking about trying, now is a great time to get started — and Ottimate can help.

With our all-in-one AP automation solution, you and your team can leverage the benefits of vCards, without interrupting your existing workflows. You’ll enjoy more secure transactions, earn valuable cashback, and keep your vendors happy with faster payments.

Ready to take your payments to the next level? Take the first step in making vCards part of your payments process by scheduling a free demo today.

Stay up to date on the latest news in AP automation and finance

Related