The WFH Bill Pay Ecosystem

by Lenny DeFranco

There’s a curious rhythm to the way society adopts new technologies over time. Mostly, it goes in cycles.

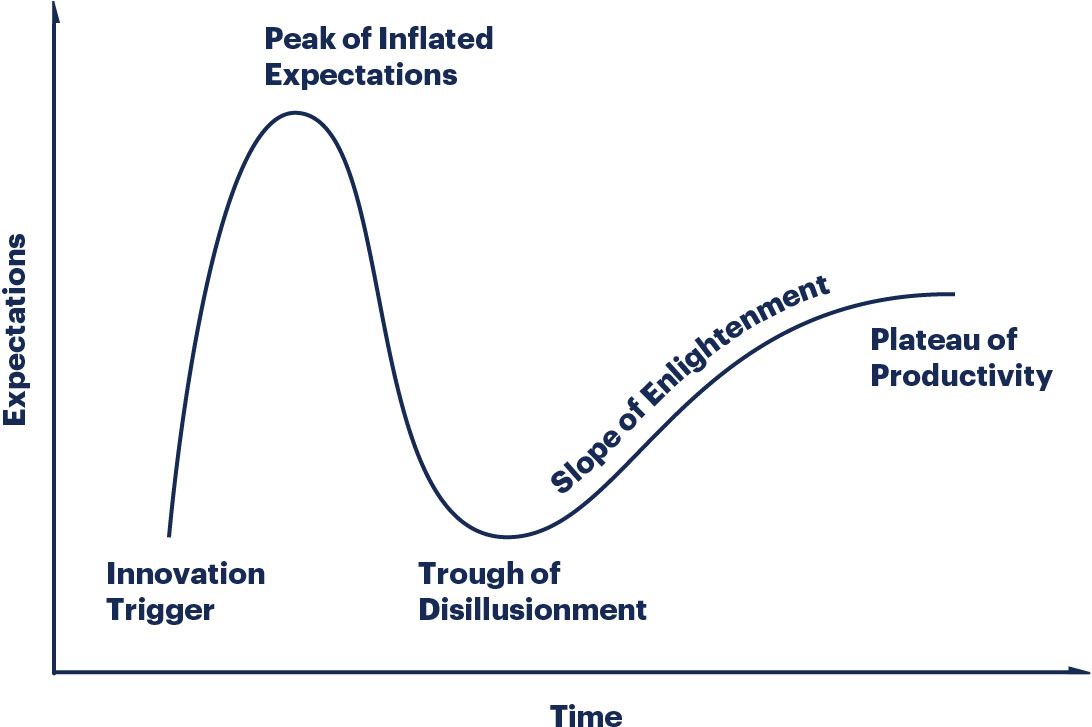

First you have a period of invention, in which a new technology is dreamed up, prototyped, iterated, and adopted by a generally small group of people. After the excitement wears off, it falls into what Gartner’s Hype Cycle calls “the trough of disillusionment.” It’s a time when the technology seems a lot less sexy than it used to be. Really, it’s just a lot less novel. Over time, the technology becomes a regular part of the makeup of our world. What was once revolutionary becomes ordinary.

But there’s a point in time beyond what this Hype Cycle diagrams: something further off to the right, in the future, that tends to jumpstart the adoption of a technology.

Crisis.

When something in the world goes wrong — whether war, recession, or something else — people marshal resources to deal with it. New technologies that have already been tested and iterated, but which haven’t gotten a lot of adoption due to normal human inertia, suddenly find themselves part of the solution to the crisis.

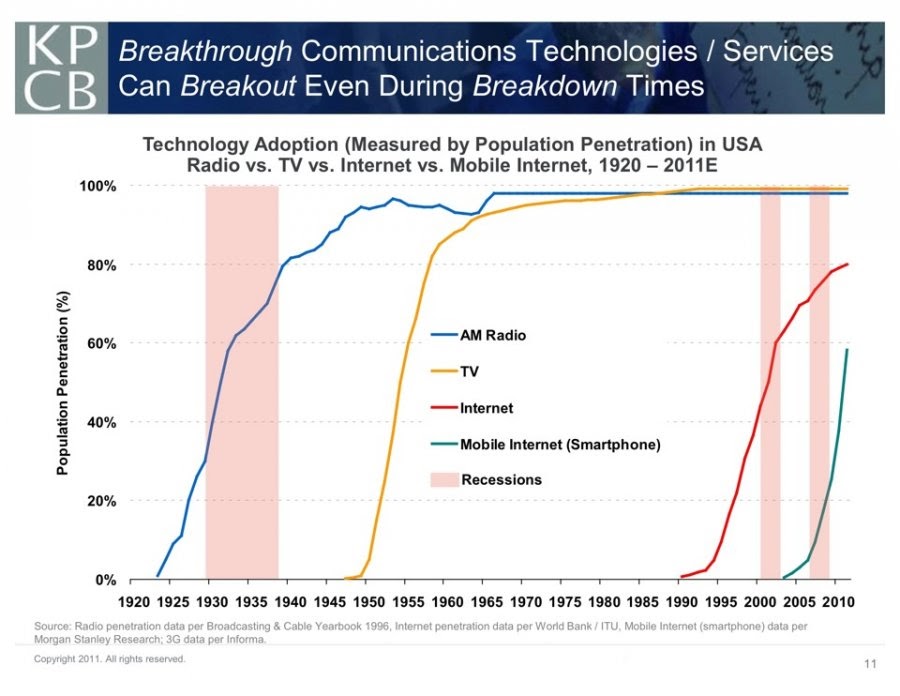

This effect has been well-documented over the decades. New forms of information technology generally see spikes in adoption during times of recession, as shown in the Mary Meeker chart above. So do new forms of office automation. When economic conditions force fewer human employees to do more work, companies take a look around for technology that can help them do that, even if they weren’t previously in the market for it.

In 2020, a new kind of crisis forced the world to learn a different way to work. When Covid-19 turned traditional offices into remote-working teams overnight, people had to change old habits and turn to new technology to get their work done.

This is the story of one.

Sending payments in a WFH world

For accountants managing AP, sending out payments used to be work they would do in-person. Vendor payments meant mailing checks and manually cross-checking records in multiple systems.

But as anyone employed during the last year can tell you, working remotely makes it much, much harder to coordinate things. AP is no exception.

Folks needed a way to track accounts payable, plan out cash flows, and ultimately make payments — all while keeping their teams in sync so they wouldn’t miss payments or double-pay bills.

And it needed to happen virtually, and in a way that matched the level of confidence they had in the manual cross-check system of old.

It was, in other words, a classic situation in which technology that has been around — and been proven — gets widely adopted only when it’s really needed. In this case, it has been the digital payments ecosystem.

The real- time rise of digital payments

In Ottimate, we can see this adoption happening in real time.

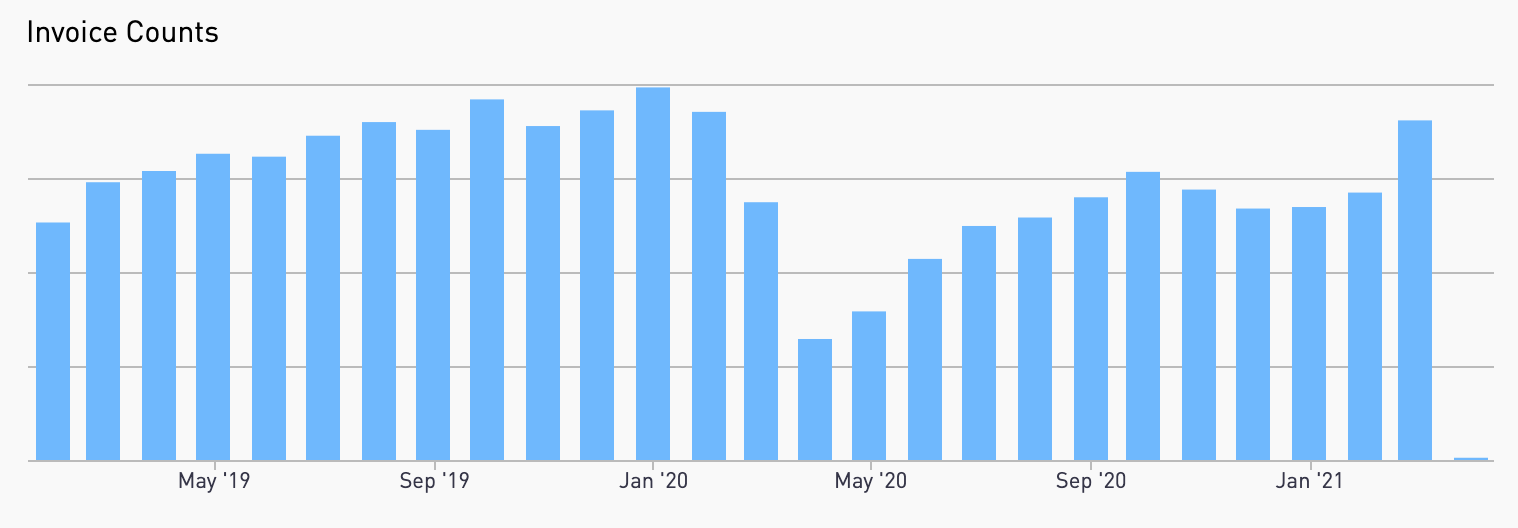

Here is a snapshot of the overall volume of invoices processed through Ottimate. You’ll notice that while we’re still below pre-pandemic volumes, we are approaching them.

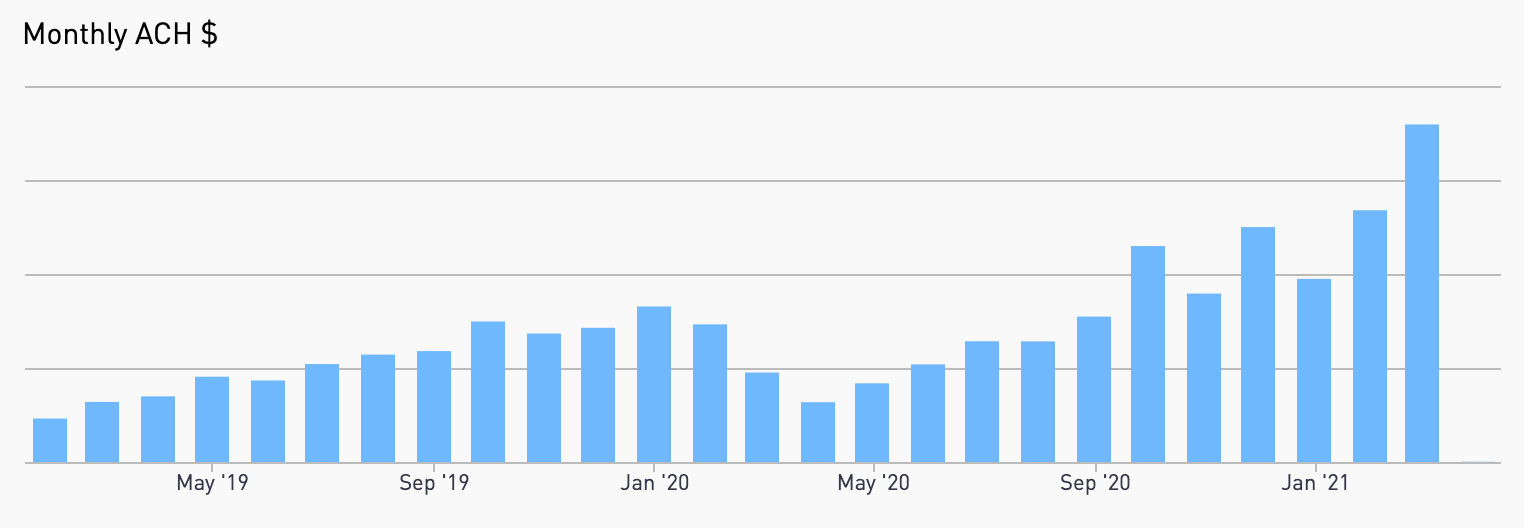

Meanwhile, take a look at the dollar value of ACH payments processed by Ottimate over the same time. This volume started setting new records during the third quarter of 2020 and hasn’t stopped since.

Together, these data points indicate a stark trend:

While Ottimate users are still working to reclaim pre-pandemic levels of business, they have shifted vendor payments sharply towards digital channels.

Why? Partly it’s because digital payments are better. Vendors get paid faster and senders get to hold onto their cash for longer. But these things were true in 2019, too.

The real reason for the sudden adoption of ACH is about the digital bill payment ecosystem, and how it solves the problems AP teams are encountering now that they’re working remotely.

How the new bill pay ecosystem works

Digital payments are better

When AP teams were no longer able to sit in the same offices for marathon check-writing sessions, they turned to virtual payments. It’s not likely that many will go back.

Sending checks in the mail incurs a lot of cost — in time, postage, and risk — before the payment even gets to the vendor. Presuming it gets to the right party, you need to make sure the cash balance of your account is ready for the check to hit. Then it’s hoping they apply the payment correctly and on time.

Digital payment rails such as ACH and virtual cards solve almost all of these problems. Payments can be sent in one or two days instead of weeks. Vendors receive their payments faster and more closely associated with the correct accounts. The risk to the senders is much smaller.

Best of all, with virtual cards and corporate card programs, paying bills earns a rebate for the AP team. Instead of incurring postage and printing costs, paying bills actually drives a small (but meaningful) amount of revenue.

Keeping cash longer while paying vendors faster is the new face of bill pay. Digital payments are here to stay.

Technology helps everyone feel in control

In a more traditional method of paying bills, a feeling of security and accuracy was purchased with a lot of effort.

Danielle Sauce, a bookkeeper at B&G Food Enterprises, a quick-service restaurant group with over 150 locations and 3,000 employees in the US, describes what used to be required for an AP operation that complex to feel secure with what they were processing.

“We did not have any type of automation system,” Danielle recalls. “We manually coded everything ourselves and keyed everything into our accounting system. Between opening the invoices, sorting them, coding them, keying them, checking them, and scanning them, we probably looked at each invoice five or six times before we were finished with it.”

Then came a world of remote work, in which that way of doing things was no longer possible.

Triple or quadruple-checking systems suddenly became much harder to do. Luckily, technology that had already been iterated and proven was there to pick up the slack.

In the remote bill pay ecosystem, security and assurance is gained not through the expenditure of effort, but by a seamless digital audit trail. Payment amounts are double-checked against invoices using automation — which also checks for duplicate invoices — and payment approvals are routed to approvers through the platform. Almost nothing gets lost; source documentation is always close by for reference. The technology, in effect, gives approvers and AP team members a sense of confidence that a manual workflow never could.

The result? Even though teams can’t meet face-to-face, they feel much more secure with the accuracy of their AP — even when processing it faster.

“We use approval rules to implement those policies in Ottimate,” Danielle says of her current workflow. “Instead of walking paper invoices over to the right person’s pile, we just load everything in and the system routes the invoices to the right approvers.

“We just make sure the store number’s right, check the date, and then we move on. So it’s cut down on our time drastically.”

Technology helps accelerate the cycle of adoption

One of the challenges with adopting digital payments has historically been finding vendors who will accept credit card or ACH payments. Even there, technology is making it easier on AP teams.

Ottimate doesn’t simply provide digital payments and leave it to users to figure out who can accept them. We actually have a team of people dedicated to reaching out to vendors and enrolling them in digital payments. The goal is for the new bill pay ecosystem to be as wide, diverse, and useful as possible.

To whatever degree in-office work makes a comeback, there are some things that our shock experiment with remote work ought to leave us with. The ability to work smarter and more securely with the help of technology is one.

For all the companies that had vague ideas about investing in these tools but were never moved to shake up the status quo, well, consider the status quo shaken. The good news is, it’s a better future for all of us on the other side.

To see how Ottimate can usher your AP team into the new payments ecosystem, schedule a demo using the button above.

Stay up to date on the latest news in AP automation and finance

Related