How to Benefit From a Virtual Payment Card With AP Automation

by The Ottimate Editorial Team

Before switching from a credit card to a virtual payment card (or vCard), consider this: In 2018, credit card fraud cost businesses in the United States nearly $10 billion dollars. Many businesses today use credit cards not only for in-store purchases, but for online services like software subscriptions, vendor payments and other remote purchases.

Using physical credit cards for online payments can be risky. This is because a credit card number on a physical card is static – the identifying information is used whenever you use your credit card. That means that once the data is stolen it can be used by anyone, not just the card owner.

Companies have taken many precautions to stop fraud from happening – from tactics like having additional approval layers, to restricting corporate cards to the C-suite. Ultimately any additional approval layers would increase the inefficiencies in payment processing, adding costs for manual reviews and time waiting for the person with the card information to be available- among other issues.

With many companies going remote, the surface attack possibilities for fraud increase. Employees would use corporate cards to pay company expenses online (since they would not be able to go into the office every day), increasing the likelihood of static credit card details to be leaked or hacked. So why change over to a virtual payment card?

What Is a Virtual Payment Card?

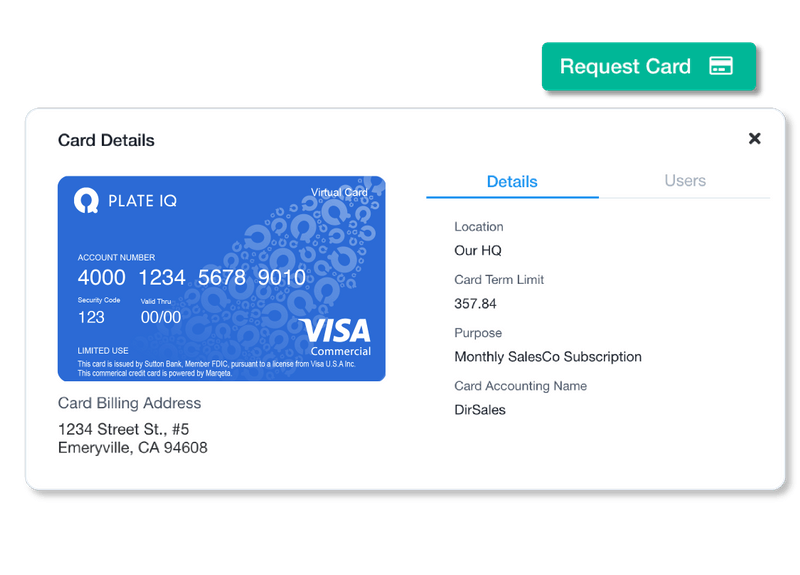

Designed as a more secure alternative to ACH and check payments, a virtual payment card, or “vCards,” is essentially a randomized and unique credit card number associated to your account.

vCards can be processed by anyone who accepts traditional credit card payments. In most cases people tend to think of this being designated to online vendors, but when used by accounts payable teams in businesses like restaurants, vCards can be a real game changer.

How Does It Work?

The vast majority of B2B vendors – whether they’re local or national, accept credit card payments. This means that they will accept virtual card payments as well.

When a vCard is created, a single-use credit card number is generated in seconds. These are perfect for secure payments since they can’t be used repeatedly. Virtual cards can be designated for many types of payment: a controller could create a vCard for a single transaction, multiple transactions within a specified purchase category, a particular monthly subscription amount — any parameter they choose. If any bad actor gets a hold of the card number and tries to use it for a purpose aside from the one the controller assigned it, the transaction would simply fail. No need for the fraud investigation.

Why Choose a Virtual Payment Card?

vCard numbers are created for specific transactions and authorized up to a specific limit. Your virtual payment cards are “locked down” to a specified amount, time limit and a maximum credit limit for every payment, which prevents misuse or fraudulent transactions.

For example, if a hacker managed to get access to the credit card numbers without the exact payment amount and/or it’s outside the time window, the card number is little more than a chain of unrelated numbers. And rendering a potential threat as useless is probably your best level of payment security!

With an increasing number of businesses going remote, it’s likely that AP teams and employees will be using credit cards more than ever to settle invoices and process payments. With less in-person interactions in the office, writing and mailing a check will fast become obsolete and potentially risky.

Although this is a welcome evolution in accounts payable, credit cards are no less riskier than ACH or check fraud.vCards solve this problem once and for all by generating single use numbers that change for every transaction.

Vendors Get Paid Faster and On-Time With a Virtual Payment Card

Ottimate today counts close to a thousand B2B vendors in our Vendor Pay network who accept virtual cards, with over half a billion dollars in invoices that could be paid through Vendor Pay.

Vendors appreciate vCards because it dramatically reduces the time spent in collecting payment and reduces errors and fraudulent transactions.

Here are some benefits of using virtual cards to pay your vendors:

- Eliminates dealing with paper checks, bank deposits, and bank check processing fees

- Automatic cash deposit into vendor bank accounts

- Less work for Account Receivables teams: No more dealing with lost or stolen checks

- Secure payment with reduced exposure to check fraud

Accounts Payable Teams Save Time and Reduce Errors With a Virtual Payment Card

AP teams love vCards because it reduces the amount of work needed to process an invoice payment. By removing the need to write and mail paper checks, payments are more secure, traceable and fraud-proof.

In addition, vCards offer the following benefits to your AP teams

- Eliminate the hassles of dealing with paper checks

- Reduce payment processing costs with more secure disbursements

- Reduce exposure to check fraud

- Improve cash management

- Generate revenue by earning rebates on AP spend routed through vCards

Virtual Payment Card and AP Automation

If you’re using an AP automation solution, and are looking into vCards, you’re already on the right track.

Established platforms like Ottimate have relationships with vendors and with the banks that are backing these cards, enabling them to handle the enrollment process for you.

In addition, many of these platforms have negotiated preferential rebates to earn cash back for you on business expenses that you’re already incurring.

This essentially means that your AP automation solution could pay for itself. Book a demo today to learn more!

Stay up to date on the latest news in AP automation and finance

Related