A Quick-Start Guide to Restaurant Financial Statements

by Jacob Statler

Templates are designed to improve accuracy, remove the guesswork, and make compiling work more efficient. They save time and shrink the room for error by following the steps of those who have done a portion of the work for you.

This is particularly true for restaurant accounting professionals responsible for preparing financial statements and recording business transactions. Using standard templates for accounting documents like income statements, balance sheets, cash flow, and aging reports can help streamline your operations and ensure consistency in your financial processes.

You opened your restaurant to indulge your love for cuisine, not to spend endless nights perfecting the intricacies of all things accounting. Follow the standard templates and you’re golden.

In this guide, we’ll explore the vital financial statements for restaurants.

You’ll Learn:

- What are restaurant financial statements

- About the following financial statements:

- How to improve your restaurant’s financial documents with automation

- How templates create consistency

Keep reading our guide on restaurant financial statements or select the topic you’re interested in above.

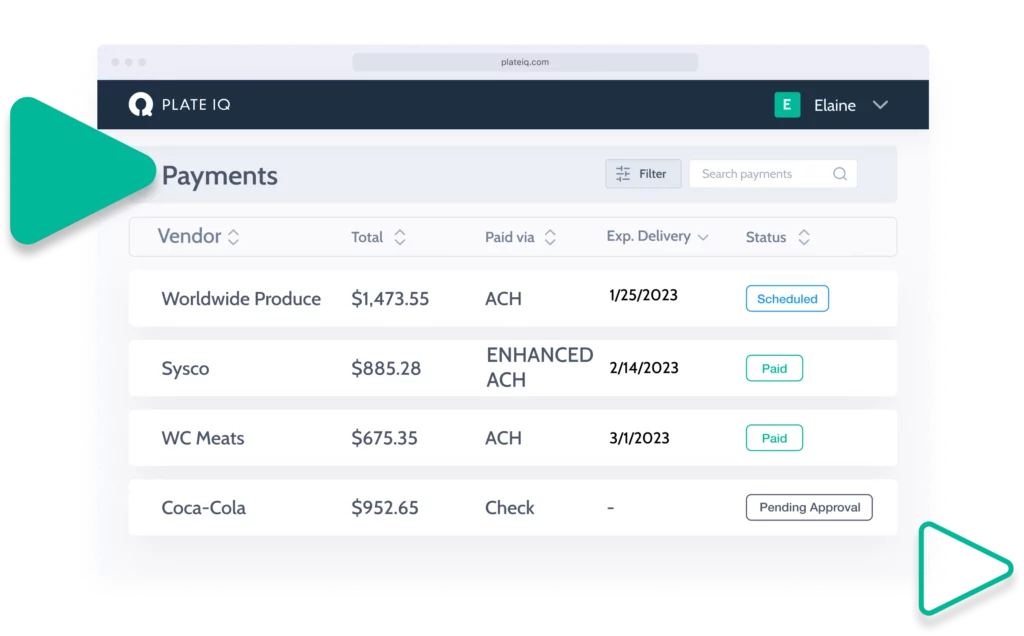

Other software just digitizes the same painful, manual process. Our AP automation AI works with you and for you across the entire AP process and syncs with your restaurant’s financial documents and tech stacks.

Uncover our success story with Cava & Zoe’s Kitchen and their now paperless workflow, thanks to AP automation.

What Are Restaurant Financial Statements?

Restaurant financial statements are formal documents that summarize the business activities of a restaurant. They give owners, investors, and advisors an outlook on a restaurant’s financial position.

There Are 3 Main Financial Statements That Should Be Prepared Periodically:

- Profit & loss statement (also known as an income statement)

- Balance sheet

- Cash flow statement

Accurate, reliable, and relevant financial information is crucial for restaurant decision-makers. That information can then enable informed business decisions. For example, opening up additional revenue streams to improve your cash flow by paying your vendors with a payment type that offers cashback.

Discover more about payment automation today.

How Often Should Restaurant Financial Reports Be Completed?

Restaurant financial statements should be prepared on a schedule created by management. While many restaurants prepare them quarterly, semi-annually, or annually, the law requires public companies to file quarterly and annual reports.

Private companies have more leeway.

However, it’s recommended that these reports are prepared monthly to gain a more accurate understanding of your restaurant’s financial health.

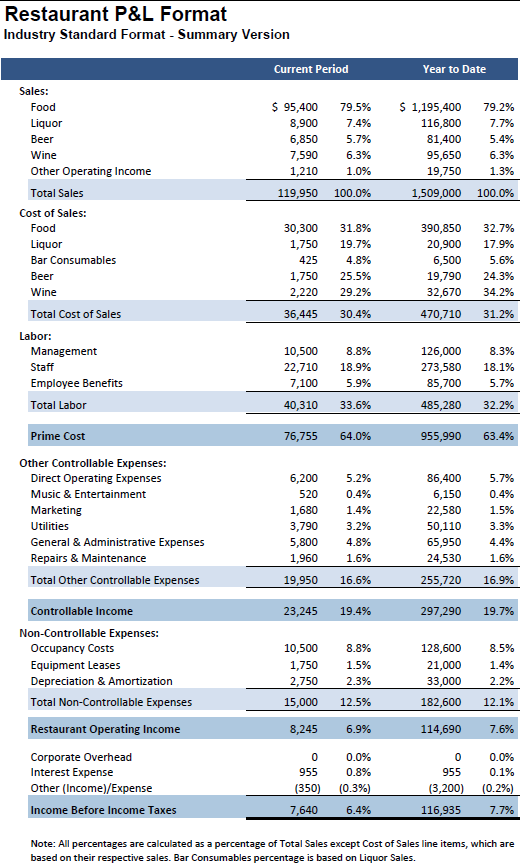

Restaurant Profit & Loss (P&L) Statement

What is a P&L Statement?

A profit-and-loss (P&L) statement is often referred to as an income statement. Both statements include the same financial data.

The income statement, or P&L statement, shows revenue and expenses and summarizes a restaurant’s finances over a stated period of time.

This financial statement reveals whether the restaurant operated at a profit or loss for the period of time covered by the statement. This time period may be one month or longer, but it doesn’t exceed one year.

These statements should be prepared over a 12-month fiscal year, occasionally starting on January 1st but often on a different schedule that aligns with your business. Any 12-month period that a business uses for its accounting purposes is considered its fiscal year.

The P&L or income statement is an important tool for measuring the restaurant management’s efficiency, effectiveness, and performance.

How to Set up a P&L or Income Statement

Set up the major categories on the income statement in the following order:

- Revenue

- Cost of Sales

- Gross Profit

- Operating Expenses

- Fixed Charges

- Net Income (or loss)

We can help you precisely manage multiple P&L statements — which can lead to you making better cash flow projections. Get a personalized demo.

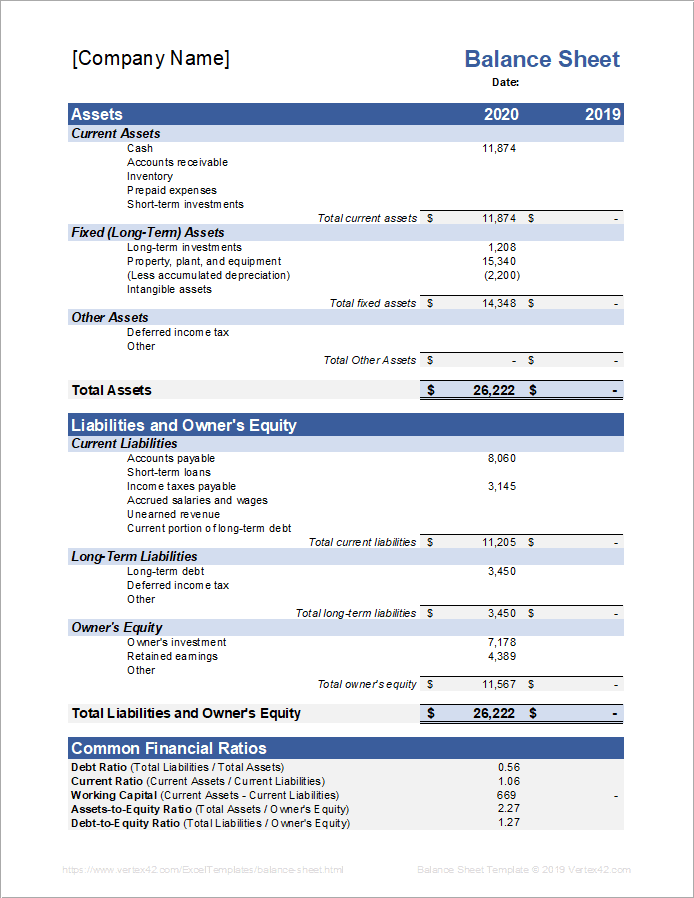

Restaurant Balance Sheet

What is a Restaurant Balance Sheet?

A restaurant balance sheet shows assets, liabilities, and equity to reveal a restaurant’s financial position on a given date.

The phrase “on a given date” refers to the document’s publish date. This has a different meaning than the phrase “for a stated period of time,” which describes a time period covered by an income statement.

As an example, a balance sheet dated December 31 would demonstrate a restaurant’s financial status at the end of business on that particular New Year’s Eve.

How to Set up a Balance Sheet

To set up a balance sheet, start with your chart of accounts which we’ll discuss later in the guide.

The balance sheet is composed of 3 major categories:

- Assets — What your restaurant owns, such as cooking equipment or inventory.

- Liabilities — What your restaurant owes for certain periods of time, like outstanding bills, lines of credit, loans, rent for property or equipment.

- Equity — The life-to-date earnings or loss.

Think of equity as net assets (the difference between assets and liabilities).

A portion of retained earnings is the restaurant’s net income from operations and other business activities held by the company as additional equity capital.

Retained earnings are thus a part of the restaurant’s equity. They represent the total equity reinvested back into the restaurant.

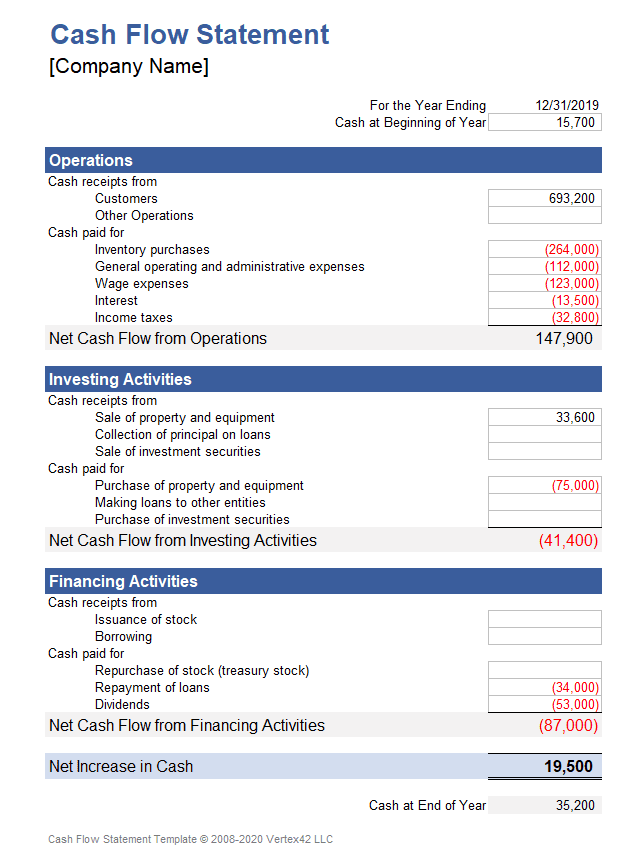

Restaurant Cash Flow Statement

What Is a Restaurant Cash Flow Statement?

The restaurant cash flow statement provides data on cash receipts and payments of the operating, investing, and financial activities of a restaurant for a stated period of time.

Every restaurant must be able to predict cash flow to ensure it has sufficient funds on hand to finance its current operations and growth. The right AP automation partner is an essential member of any revenue-generating finance team (yes, even for restaurants!). Make strategic decisions based on error-free cash flow data – and earn cashback along the way.

The income statement, operations, and balance sheet should also be prepared during the same time period covered in the cash flow statement to fully grasp the restaurant’s financial position.

The cash flow is a net result of cash receipts and cash payments.

If cash receipts are greater than cash payments, the result is a positive cash flow called Cash Inflow. A negative cash flow, also called a Cash Outflow, is the result of cash payments being greater than cash receipts.

How to Set up a Cash Flow Statement

A cash flow statement is composed of 3 major activity categories:

To calculate your cash flow, start with your Net Income. Next, add up your Cash Inflows from Sales minus the Operation Outflows. Finally, compare your Ending Cash with your Beginning Cash.

The change is your Net Cash for the reporting period.

Restaurant Aging Report

What Is a Restaurant Aging Report?

It’s not technically a financial document as it’s not something being reported to authorities and investors. But keeping a smooth set of books is essential.

An aging report is the sum of accounts receivable a restaurant will collect in the future or the sum of accounts payable the restaurant will pay out in the future.

Both are based on credit approvals.

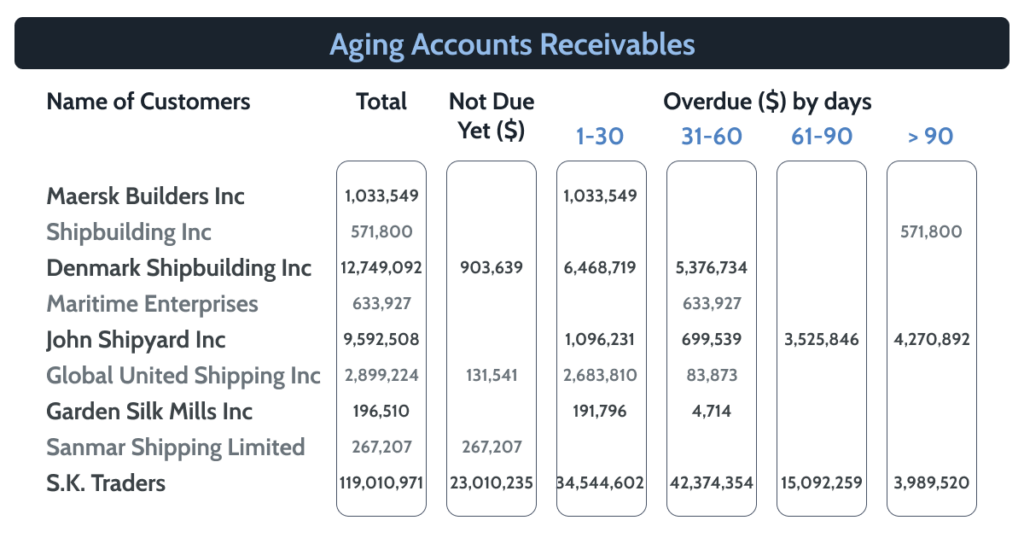

An aging report shows the duration of uncollected and unpaid invoices. Usually, the report sorts invoices into 30, 60, 90, or 120 days outstanding.

Accounts receivable aging appears on the balance sheet account as an Asset because this will be future restaurant income while the accounts payable aging appears as a liability because these invoices represent future expenses.

It’s crucial for the director of finance or accounting to manage the AR and AP aging reports and credit approvals based on cash flow statements.

How to Set up a Restaurant Aging Report

Aging reports are set up in columns beginning with vendor/client name/customer listed alphabetically, followed by Total Amount Due and Number of Days Outstanding.

Restaurants can rely on Ottimate to generate aging reports with real-time, trackable invoice insights.

Restaurant Chart of Accounts

What is a Chart of Accounts for Restaurants?

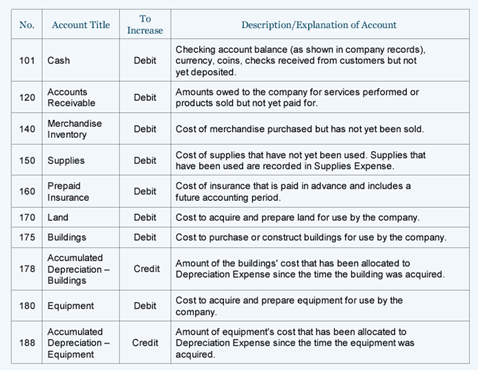

Your chart of accounts is vital for organized restaurant finances, even though it isn’t a financial statement. It’s a list of the names of all accounts used by a particular business.

A chart of accounts doesn’t show account balances. Its main purpose is to serve as a “List of Ingredients” for bookkeepers to use as a guide when entering business transaction results into accounting records.

On a restaurant chart of accounts, the main account classifications are as follows:

- Asset Accounts

- Liability Accounts

- Equity Accounts

- Revenue Accounts

- Expense Accounts

Each of these main accounts should have sub-accounts under them.

For example, under Asset Accounts, sub-accounts could be Cash on Hand, Cash in Bank, Accounts Receivable, etc.

Note: Bookkeepers aren’t allowed to use an account unless it already appears on the company’s chart of accounts.

How to Set up a Restaurant Chart of Accounts

You’ll need to set up your chart of accounts using a number system.

To use computerized recording software, such as QuickBooks, you must assign a specific account number to each account. So you’ll need to assign account numbers with a designated digit to represent each of your major account classifications.

For example, let’s assume your restaurant accountant designs a 3-digit accounting number system. And since the first major account classification is “Asset S”, the number 1 is assigned as the first digit for all “Asset S” account numbers. Therefore, the number series of 1xx will apply to all Asset Accounts.

Cash is the first sub-account appearing under Asset Accounts. Therefore, in the 3-digit accounts numbering system, the account number assigned for the Cash account will be 101.

Follow the same recipe when cooking up your chart of accounts (COA) for your own restaurant business. Here’s an example of what that could look like:

- 100-Asset Accounts

- 101-Cash

- 200-Liability Accounts

- 300-Equity Accounts

- 400-Revenue Accounts

- 500-Expense Accounts

Ottimate’s invoice automation software helps you upload and map your invoice items to your chart of accounts. The best part? You only have to do it once — the next time you have that item, our mature AI automatically & accurately codes it to your GL.

Improve Your Restaurant Financial Documents With Automation

Most of the day-to-day work in accounting is made up of daily, repetitive tasks.

Using automation with your financial statements is a savvy business decision for any restaurateur.

It’s important that your restaurant’s Point of Sale (POS) software allows integration with other software to enable task automation in completing financial statements.

Discover how AP automation gives you the ability to streamline your accounting systems and seamlessly integrate with your platform of choice.

Templates Create Consistency

Templates help save time, create consistency, and drive organization in your restaurant accounting system. They take the guesswork out of recording your financial information and enable you to stay on top of your restaurant’s finances.

This gives you more time to focus on what you love most about the restaurant business — creating killer food and an amazing customer experience.

Article updated on October 26, 2023.

Stay up to date on the latest news in AP automation and finance

Related