5 Surprising Ways Restaurant Accounting Affects the Guest Experience

by Maddy Osman

Many restaurant owners write off accounting as another housekeeping item that’s more of a necessary evil than a strategic opportunity. However, the way you handle your accounting can significantly impact your guests’ experience — for better or worse.

Keep reading if you want to see how your bookkeeping can elevate your guest experience and keep consumers coming back.

What Defines a Superior Restaurant Experience

As a business owner in the restaurant industry, you aim to create the best experience for your guests. But what do restaurant-goers care about the most?

Industry surveys reveal that food quality and efficiency matter most to consumers.

For the majority of guests, food quality trumps value and price point. When surveyed, 72% of guests listed quality of food as their top priority, and 63% chose taste and flavor preferences.

After food quality and flavor preferences, guests rank value (48%) and price point (33%) as the most important factors when choosing a restaurant.

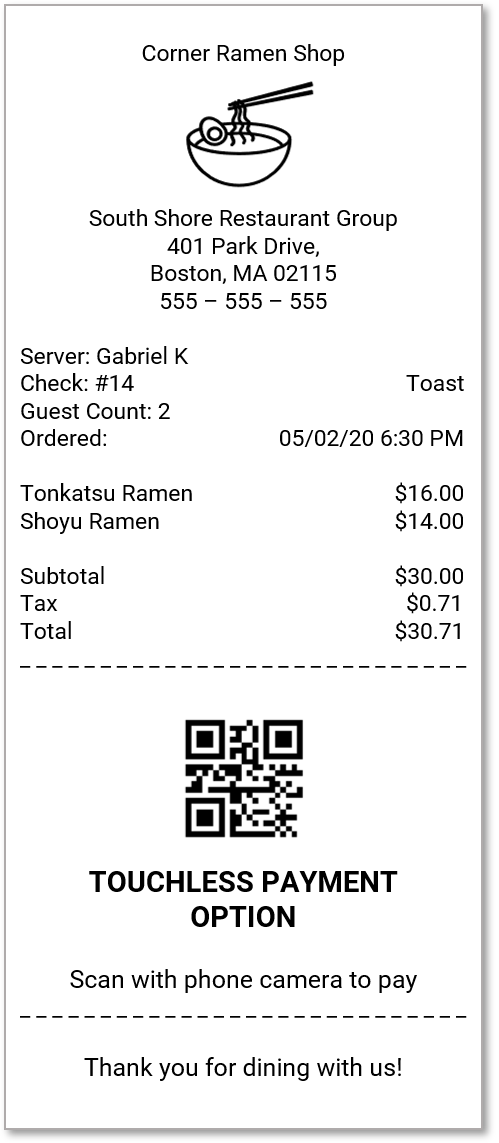

Restaurant-goers also value convenience and efficiency in the dining experience, particularly when it comes to payment. Guest preferences increasingly lean towards easy payment options such as mobile pay.

The study results also show that 67% of respondents crave convenience and opt for the fastest payment option.

5 Ways Restaurant Accounting Affects Your Guests

When thinking of how to craft the best guest experience in the restaurant business, accounting likely isn’t the first tool that comes to mind. Nevertheless, your accounting business decisions can have a significant impact on a patron’s visit.

Here are the top five ways accounting affects your guests.

1. Food Quality

Staying on top of your accounting tasks helps you pay vendors on time and build positive relationships with your suppliers. When your vendors trust and like you, they’ll make sure you receive high-quality ingredients so you can provide quality food to your guests.

In contrast, missing payments can result in poor vendor relations and late fees.

If you’re not a priority customer for your vendors, your food quality will suffer. Not to mention, accruing late fees can eat into the money you have available to purchase ingredients, and you’ll have to compromise on quality.

2. Timing

Restaurant guests don’t like to be kept waiting for tables or food. When you’re understaffed on a busy shift, the guest experience suffers.

Although staffing your restaurant each day may seem like more of an art than a science, sound accounting practices can help. Automatically tracking daily sales reports and labor costs lets you figure out the optimal number of staff you need on each shift to keep the experience smooth.

3. Payment Efficiency

You may think that the accounting software you use doesn’t matter to guests, but that’s changing. In particular, restaurant owners should pay attention to consumer preferences related to new payment technologies such as mobile pay and handheld credit card readers.

According to a survey conducted by Appetize, 43% of U.S. restaurant patrons would like to see more tap-to-pay checkouts, and 34% would like to see more waiters with handheld payment devices.

Using accounting software that integrates with various payment methods helps you adapt to guest preferences by offering efficient payment options.

4. Item Availability

When guests arrive excited for a meal, the last thing you want to do is tell them that the dish they wanted has run out. Unfortunately, shoddy inventory management and forecasting can lead to shortages of key ingredients.

With proper accounting technology and practices in place, you can use past data to make better decisions for ordering ingredients and preparing food. This way, you reduce food shortages, and your guests can always get their first-choice food and beverages.

5. Growth Potential

Finally, adhering to modern restaurant accounting tips can help support restaurant growth so you can serve more customers. By understanding trends in your food sales and inventory costs, you can make decisions that improve your profit margins.

For example, accurate reporting can tell you if you’re spending too much on labor costs during the weekdays.

Restaurant Accounting Tips

- Find the right tech for front and back of house

- Stay on top of your costs

- Prioritize inventory management

Find the Right Tech for Front and Back of House

Whether you have a restaurant accountant or handle your restaurant’s finances in-house, the right software makes a difference. In particular, make sure the restaurant accounting software you choose supports everyone on your team.

For your front-of-house staff, make sure you find a Point-of-Sale (POS) that’s easy to use so they can serve customers efficiently. You also need a POS system that supports efficient payment options like splitting checks or mobile pay.

Then, check in with your general manager, head chef, and back-office staff to make sure they have everything they need to handle inventory and menu planning.

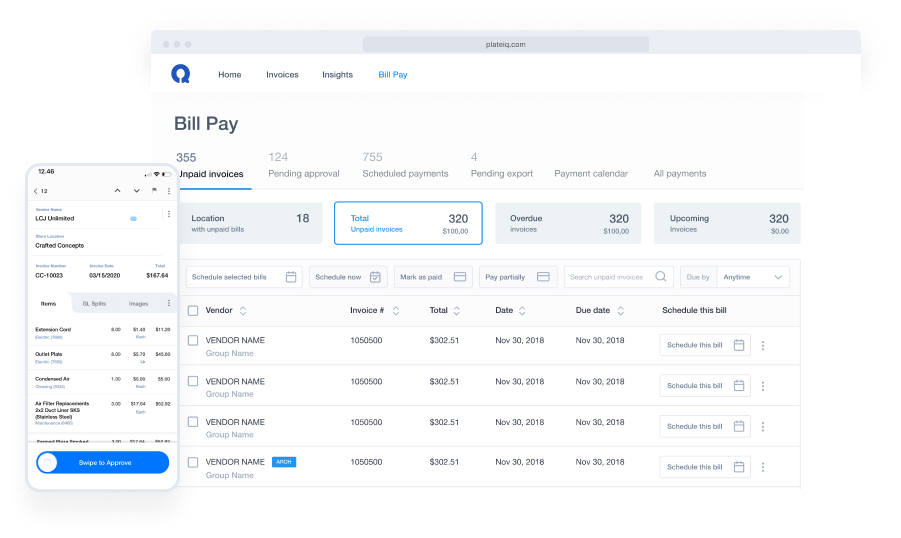

For example, you can support your back-of-house staff and office team with accounts payable automation and automated invoice management.

Stay on Top of Your Costs

If you’re not watching your restaurant expenses closely, they can quickly get out of hand. In particular, keep an eye on your operating expenses, food costs, and prime costs.

Use software to automate accounting report generation so you can accurately track your spending over time and see where your money goes.

Solutions like Ottimate can automatically add GL codes while processing invoices, saving you time and reducing manual errors in your financial records. With automated invoice processing, you can also streamline approval processes so vendor payments go out on time.

Prioritize Inventory Management

Inventory management can be time-consuming, but it’s a crucial part of an effective accounting process. Integrating inventory management with your accounting software empowers you to reduce your Cost of Goods Sold (CoGS) and optimize your menu items so ingredients are always fresh.

Perform inventory check-ins on a weekly basis to keep your data accurate. Equipping your accounting system with the right tools helps you spend less time on restaurant bookkeeping while also improving recipe costing and menu engineering.

Final Thoughts: Restaurant Accounting Tips To Improve Your Guest Experience

It’s true — your guests won’t see your General Ledger or your profit and loss statements. But that doesn’t mean you can separate accounting from the guest experience.

Including modern restaurant accounting practices in your business plan lets you optimize the guest experience, improve profit margins, and increase your bottom line.

For more information about automated invoice management and vendor bill pay, explore Ottimate for restaurants today.

Stay up to date on the latest news in AP automation and finance

Related