Say Goodbye to Paper Checks: Alternatives for Paying Invoices

by The Ottimate Editorial Team

Are paper checks becoming a relic of the past?

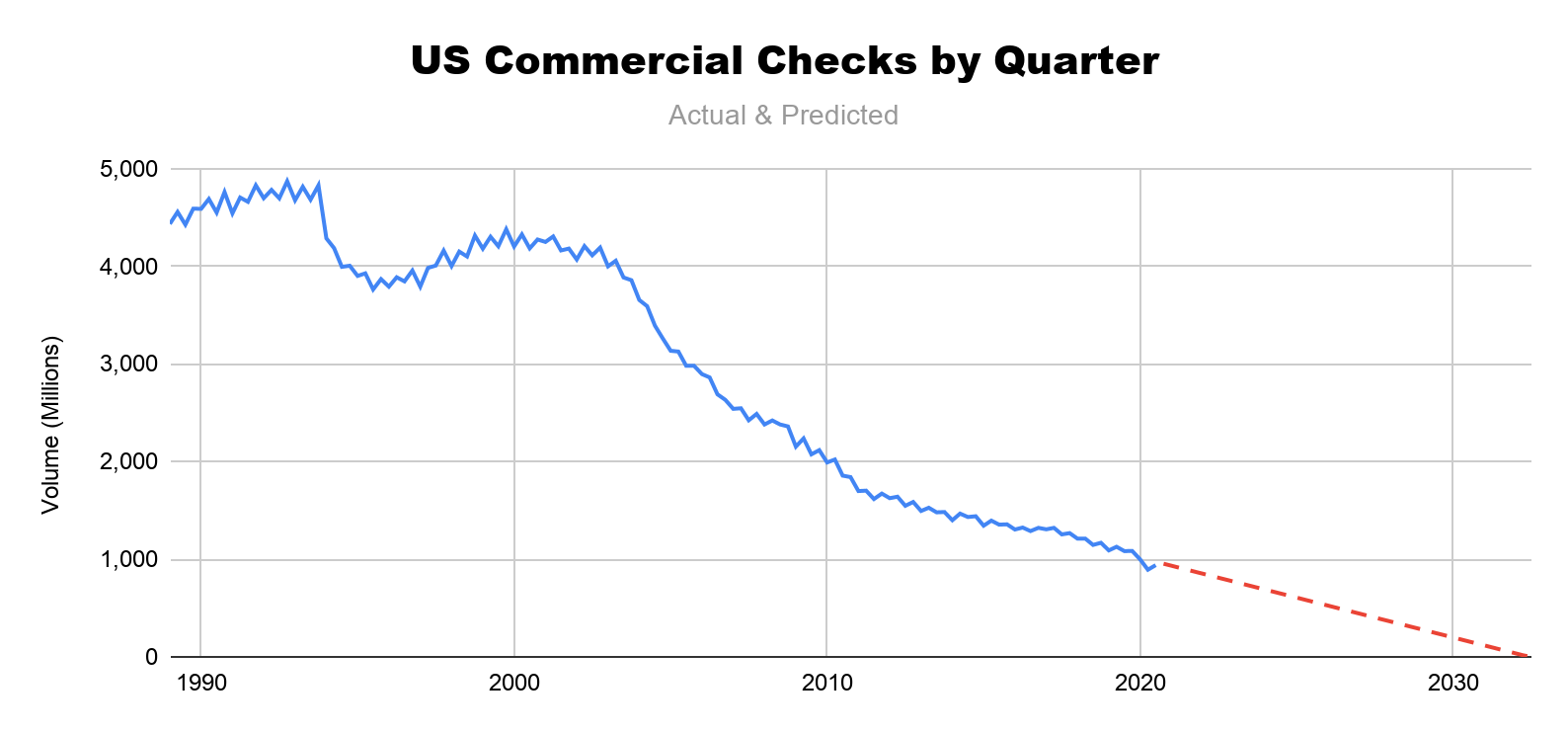

As digital payments increasingly replace the role paper checks have played since the 1940s, fewer and fewer businesses are sending checks each year. Last year, the Federal Reserve reported that in the second quarter of 2020, US businesses sent a total of 893 million paper checks — an all-time low.

Projecting the data outward, it’s not crazy at all to wonder if the 2020s will be the final full decade in which paper checks are sent at all.

If the demise of this familiar form of payment is nerve-wracking, we’re here to tell you that it’s getting replaced with something that is safer, more secure, and better for your business.

Checks were cutting-edge technology a few decades ago, but these days, financial controllers have far superior forms of payment tools available to them. While sending a check may seem cheaper on the surface, the cost of manually writing, tracking and mailing paper checks far outweigh any benefits.

If you’re still paying your company’s or client’s invoices by sending paper checks, it’s time to ditch the check and meet the new methods of bill payment.

A Brief History of the Humble Paper Check

In the absence of financial networks or credit scores, businesses prior to the 20th century either extended credit on a one-to-one basis or demanded “cash on the barrelhead,” a term thought to originate from the use of barrels as both barstools and tabletops in American frontier towns.

But cash was inconvenient. Until the Civil War, cash in the US was only available in coins. Not only was it hard to carry around sacks of metal, whether gold or silver or minted coins, but there was often too little coinage in circulation to clear transactions properly. So even before paper cash became standardized, checks were a critical part of the nation’s financial infrastructure.

Early checks were little more than IOUs: notes written on irregular pieces of paper, signaling that a certain amount of money was redeemable from a certain bank. The first printed checks appeared in the UK in 1762, and included serial numbers that allowed a banker to “check” the slip against records — likely giving this form of payment its name. The system, as you can imagine, was rife with fraud.

Modern checks didn’t emerge until after World War II. In the 1950s, Bank of America asked researchers at Stanford to devise a way to automate check processing. At the time, human hands had to sort and add up totals six times per check — and there were around 28 million being written every day in the US. What the researchers devised was a system that could be read by machines and humans, including the distinctive font used to print numbers at the bottom of checks, called E-13B.

Check writing in the US peaked in 1995, when Americans wrote 49.5 billion of them. By that time, consumers and businesses had already started turning to electronic payment systems like the Automated Clearing House (ACH) network and digital tools provided by financial institutions.

Still, for many business operators, bill payment is synonymous with paper checks. The familiarity of the format and the “it just works” simplicity of the user experience has meant that many businesses have been loath to give up writing checks.

If you’re in that camp, it might be time to reassess your bill pay options.

Paper Checks Aren’t as Reliable as You Think

Checks seem like such simple instruments: you write one, you send it, and money changes hands. But underneath this interaction is a complex system devoted to shifting that piece of paper around. And as always, the more complex a system, the greater the surface area of attack for fraud, as well as other issues.

Check Payments Are Subject to Mail Delays

The first problem with paying invoices via paper checks is that in order to get them to the vendor, you need to rely on a delivery system: the US Postal Service, a private shipper, or a dedicated courier.

By far the most common method is simply dropping the check in a mailbox.

The US Postal Service is a feat of modern logistics, and chances are high the check will get there. But mail delays are common, and they’re getting more frequent.

For many businesses, paying vendors on time is an important aspect of building a good vendor relationship. Given the timeliness of bill payments, minimizing your exposure to the unpredictability of mail delivery is a good idea.

Check Fraud Involving Paper Checks Is Commonplace

According to the American Bankers Association, check fraud accounted for almost half of all US deposit account fraud losses in 2018 — $25.1 billion — and increased 31% from two years prior.

It’s not hard to see why: as a relatively low-tech payment mechanism, attacks on the system do not need to be very sophisticated. Common methods include forged signatures and counterfeit checks. Each check exposes account and routing information to anyone who gets their hands on it. Banks are pretty good at catching these attempts, preventing over 88% of check fraud before the customer incurs a loss, but while they go through the review process, the business would lose access to the funds that are at risk. Why go through the headache if you don’t need to?

You’re at the Mercy of the Vendor

Once a check gets to the vendor, you are relying on their accounts receivable team to process the check properly.

First that means them not losing the check in the office. Then there’s the hope that the check will be attended to in a timely manner so you don’t incur any penalties for late payment. Finally, the vendor’s AR team needs to apply the check to the right account and in the right amount — probably making entries in multiple systems, ledgers, and journals.

This is quite a bit of manual work that has to be done correctly. You control none of it.

There Are Better Alternatives to Paper Checks

Better ways to pay your vendors have been around for the last few decades. These new methods of bill pay are digital, involve fewer moving parts, and are easier to safeguard.

ACH Payments

The Automated Clearing House network is the principal system of electronic funds transfer in the United States. It was created in the 1970s to allow regular, predictable payments to be transferred without paper checks. Stability, not speed, was the founding principle. Today, it processes around 90% of all electronic funds in the US.

The ACH network is run by a nonprofit governing body called NACHA, which is part of the Federal Reserve system in the US. Its technology isn’t fancy — or modern — but it gets the job done.

An ACH transaction starts out as an instruction sent from an originating bank to a recipient bank. The instruction is sent as a digital file through the Federal Reserve, which acts as a clearing house. The recipient bank must process their backlog of instructions by specific times each day, which are deadlines known as “settlement windows.” In this way, money transfers from one financial institution to another.

The ACH network is stable but relatively slow. In the last few years, NACHA has added two new settlement windows to each day’s schedule, enabling same-day ACH payments and bringing the system closer to the dream of real-time payments, which have existed for years in countries with more unified banking systems.

Corporate Cards

Not every vendor accepts credit card payments, but for those that do, the benefits of using a corporate card can be substantial.

Many corporate card programs today offer cash back to the cardholder. A 1% cash back card, for example, returns to you $10.00 for every $1000 you spend. This rebate adds up over time, and for small businesses especially, can be an important factor in reducing costs.

Still, corporate cards do not scale well. Using one card for multiple transactions not only exposes that credit card number to different vendors — increasing the chances of the card getting compromised due to bad activity — but they have to be shared by different employees for completely different types of purchases, making it harder to easily analyze your card spend.

And as with all credit cards, there’s no way to prevent spend before it happens. Much of your spend control relies on previously-communicated spend policies, or the best discretion of the cardholder.

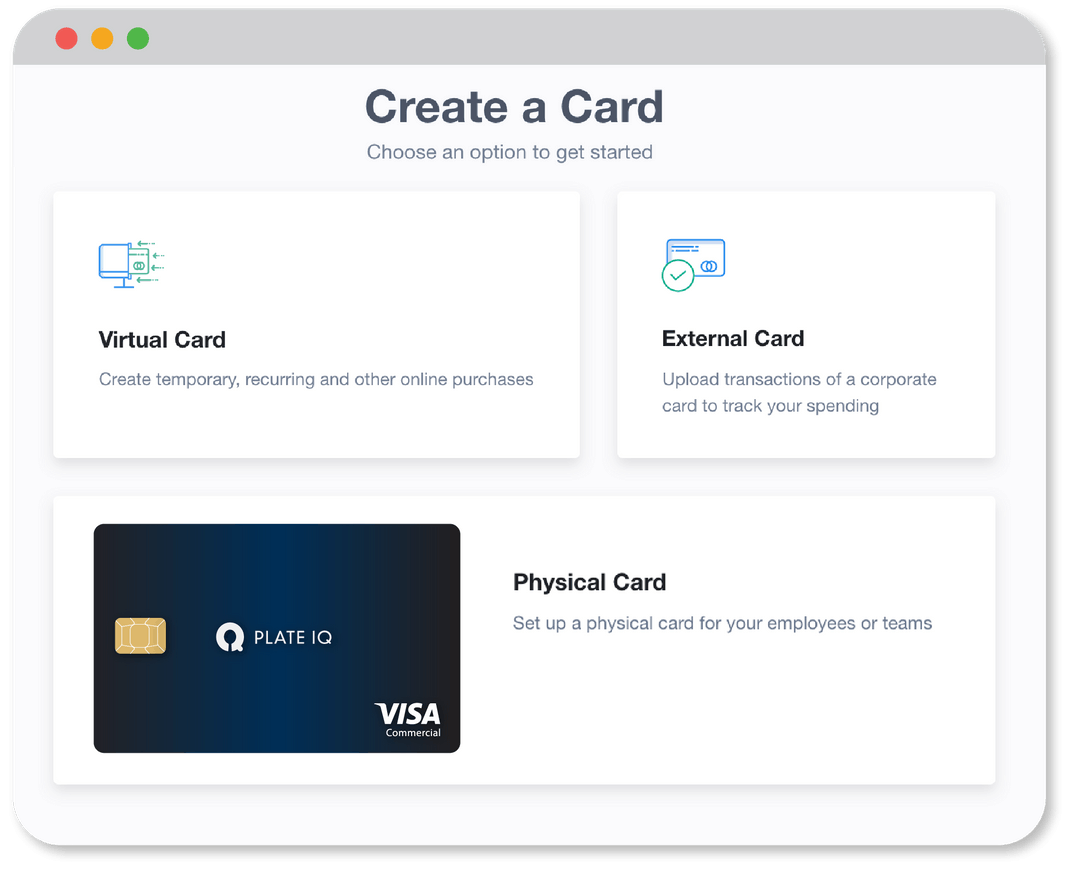

There is, however, a newer form of payment that allows businesses to enjoy the benefits of corporate cards with a higher degree of security, control, and convenience.

Virtual Cards (The Best Option of All)

Instead of sending a paper check through the mail, triggering an ACH payment, or using a credit card to pay for an invoice, a growing number of AP teams are using virtual cards, also called vCards.

A vCard is not a physical card at all, but simply a 16-digit card number (along with an expiration date and CVV number) attached to an account. It can be used to send payment just like the number on a physical debit or credit card can, but with two major differences:

- A new number can be generated whenever you want. Each individual transaction or series of transactions can get their own dedicated card number.

- The person generating the vCard can control its parameters before it is even created, setting crucial spending controls like the maximum dollar amount available, the time limit of the card, and even the category for which the card can be used.

These two controls greatly increase the security and scalability of the vCard. A controller creating a vCard for a bill payment could specify the exact dollar amount of the invoice being paid, set the expiration date to the end of the current month, and submit the card through the vendor’s normal credit card portal. Any attempt at fraud will fail against the card’s tight parameters, and the card number gains no access to the rest of the company’s account.

Best of all, vCards enable the company to continue to earn cash back from their corporate card program. Unlike paper checks, which require postage, vCards actually earn money back for the business for using them — in exchange for faster, safer, easier payments.

Get the Security, Scalability, and Cash Back of Ottimate’s Vcards

Ottimate’s Bill Pay functionality supports all of the above methods of payment. You can use our platform to schedule ACH payments, monitor your corporate card transactions in real time, and yes, even schedule paper check runs that you never have to touch yourself.

But the payment method we believe will be most powerful going forward is virtual cards. No other payment method offers the same combination of benefits — including cash back — while solving for so many problems that paper checks create for businesses.

Save the envelopes and mailboxes for your pen pal. When it comes to paying invoices in a timely and secure manner, and in a way that guarantees control and easy accounting, say goodbye to checks and switch to virtual cards.

Ottimate offers vCard Bill Pay right inside your invoice software. To see it for yourself, schedule a demo.

Stay up to date on the latest news in AP automation and finance

Related