Ottimate Data Shows That Digital Payments Are Here to Stay

by Lenny DeFranco

For all intents and purposes, the coronavirus pandemic is heading towards its end in the United States. As of today, over 47% of our population has been fully vaccinated against COVID-19, with 327 million people having received at least one shot for a modicum of immunity.

Some might feel like the days of quarantine are already behind us. Summer vacations are back on the calendar, long-postponed weddings have been rescheduled, and business is booming once again. But the pandemic has fundamentally changed our ways of thinking and challenged our status quo, forcing us into prolonged periods of stress and resiliency.

As we emerge on the other side, we should reclaim the new normal as a beacon of hope that forces us to reexamine the way we work. Here, we’ll take a look at how the pandemic has ushered in a new era for accounting teams—and why the shift is here to stay.

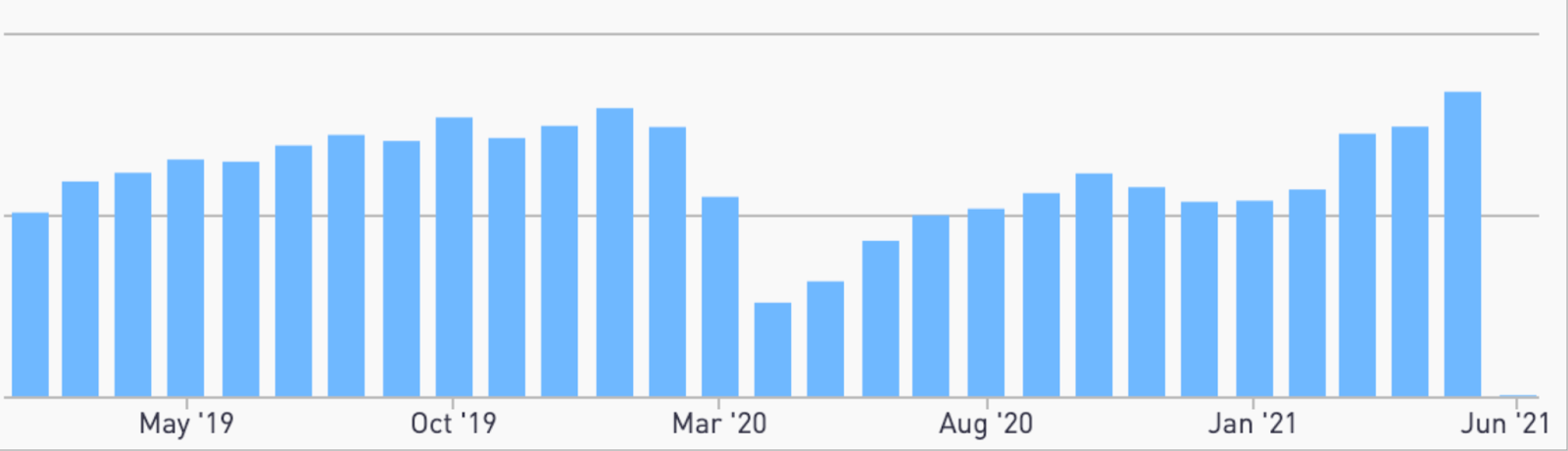

Invoice volumes have stabilized

As more people return to restaurants, hotels, and country clubs, the amount of goods those businesses sell should increase. Ottimate’s data supports this logic, demonstrating that our customer’s invoice volumes have already returned to — and, don’t look now, but begun to exceed — pre-pandemic levels.

It’s an extremely exciting data point to see for business owners who have struggled through closures, pivots, and delivery dependence for over a year.

With summer vacations, rescheduled COVID weddings packing the fall, and an always-busy holiday season still to come this year, we’re anticipating the number of invoice scans to continue to rise across the industry through 2021.

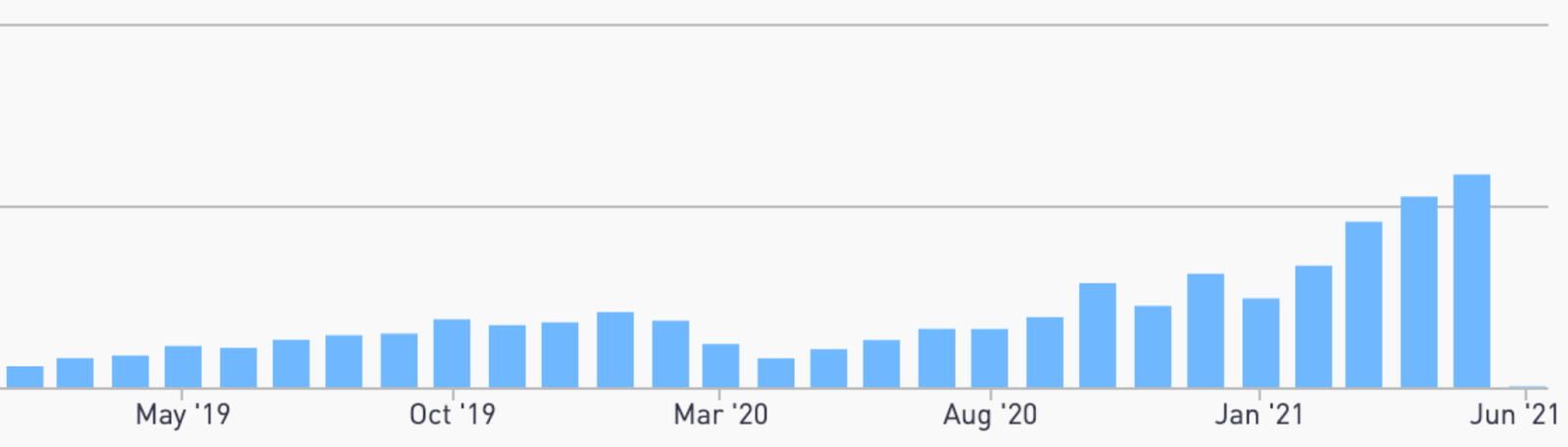

Digital payments are on the rise

More invoices create more work in Accounts Payable (AP). In the pre-pandemic ways of working, most accounting teams were operating with paper invoices and paper checks. But as the world was forced into remote and hybrid models of labor, the industry had to adapt.

As we’ve discussed before, crisis forced adaptation of ACH for business to business payments. ACH has been around in some form since the 1970s, but it took the largest public health emergency of a lifetime to usher in this new way of working at scale. And all indicators seem to be showing that accounting teams are permanently adopting digital bill pay.

The Y axis shows how much money has been processed through Ottimate Bill Pay’s ACH. Though the tech was slowly gaining traction by the end of 2019 and start of 2020, there was much less money flowing in and out of hospitality businesses by March 2020. But once more was known about the pandemic and folks started to adapt to new ways of working, digital payments started to flow freely.

Though the number of invoices we processed is about the same as January 2020, significantly more money is getting paid to vendors—the entities that actually issue the invoices—through digital channels than ever before. As we anticipate the number of invoice scans continue to rise in H2 2021, the sum of digital payments will likely rise at an even faster rate.

Nacha, the administrator of the ACH network, has data that backs up the trends we’re seeing on our platform: ACH volume hit 2.7 billion payments in March, the largest in the network’s history. But there’s also plenty of anecdotal evidence to suggest that digital payments are the new normal for accounting teams.

A brave new world of bill pay

These teams are accustomed to working shoulder-to-shoulder, passing invoices back and forth, manually entering their data into accounting systems, and then finally writing checks to be sent in the mail for vendors awaiting payments. So bookkeepers, accountants, and other finance professionals had to adapt quickly to ensure that the bills got paid, even with a remote team.

Digital payments, including both ACH and virtual cards, became a lifeline for AP processes, enabling them to be done more efficiently than ever before.

Instant payments

The USPS had its own host of issues during the pandemic. But even as mail was delayed, payments still needed to be made to vendors. By using digital payments, AP teams could directly route money to whoever needed to be paid—without planning weeks ahead to cut a check that could actually take a month to arrive.

Better visibility

These instant payments are also traceable. Paper checks could only really be traced if they were sent with a tracking number; usually the only indicator that they were received was if they appeared as a debit in the company coffers. With digital payments, AP teams could have the confidence that bills were paid exactly when they needed to be.

Approvals routing

Visibility is important not only to track payment, but also to track the members of the team who are actually reviewing invoices and outstanding balances. Ottimate’s Bill Pay gives AP professionals the opportunity to only review the documents they need to see, exactly when they need to see them. Folks working remotely can simply be notified with an email when documents are ready for review.

Enhanced privacy

Approvals routing also opens the opportunity for more security around valuable business data. Rather than loose paper that can be rifled through by anyone with a key to the back office, only people who have been given specific access to data in Ottimate can see this sensitive information.

A recent McKinsey analysis found that over 20 percent of our workforce could work remotely three to five days a week as effectively as they could if working from an office. But with technology like digital payments trending, we think that accounting teams might actually be more effective at work than ever before.

Keep checking back to our blog for more updates and data analysis as we continue to explore the impact of COVID on the hospitality industry.

Stay up to date on the latest news in AP automation and finance

Related