3 Best Ways to Pay Vendors: vCard Payment vs. ACH vs. Check

by The Ottimate Editorial Team

Virtual card (vCard) payment vs. ACH vs. check — have you wondered what the best way to pay your vendors might be?

We’ve put together a guide to help you make the wisest decision on streamlining your vendor payment process.

We’ll cover:

- The best way to pay vendors

- vCard payment vs. ACH vs. check

- How automated invoice processing streamlines the vendor payment process

- How to implement digital payments

With automated invoice processing and the electronic vendor payment options available, your life can get much easier quickly.

Digital payments can save you money, cut down on errors, and make for some happy vendors.

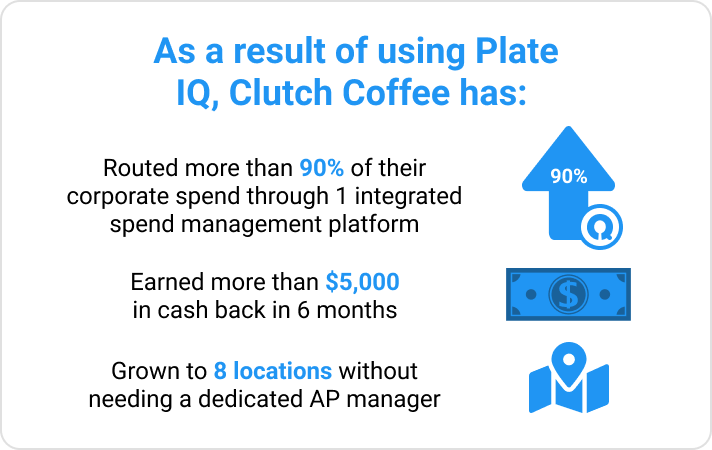

Read how North Carolina’s Clutch Coffee keeps all its Accounts Payable (AP) under one roof using the Ottimate card for all vendor payments.

All of our virtual cards are pre-assigned to a GL account so that when transactions come through on them, they’re immediately classified to a particular expense account and exported to NetSuite. That’s huge.

— Jake Vandermeer, CFO of Clutch Coffee

The 3 Best Ways to Pay Vendors Digitally: vCard Payment vs. ACH vs. Check

When it comes to the best way to pay your vendors, you’ve got options. As AP continues to step away from paper checks, three formats for electronic B2B payments have risen to the top:

- vCard Payment

- ACH

- Check

All three have value and can benefit you and your restaurant. So let’s dive into each one and give you more detail, plus pros and cons to guide you toward the best option for your vendor payment process.

vCard Payment

Virtual Cards or vCards, combine the benefits of physical purchasing cards, the functionality of a check, and the efficiencies of ACH to improve cash flow, reduce fraud, and pay your vendors faster.

They offer a controlled invoice process because you can control how much is spent and who is paid.

Probably the single most strategically important aspect of a good vCard program is that it shifts accounts payable from a source of overhead costs to an engine of revenue creation.

The rebates that virtual cards deliver are the tangible expression of this revolution in accounts payable in every organization, especially in the restaurant industry.

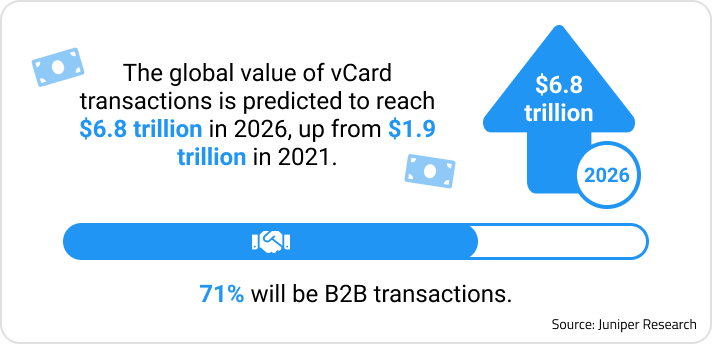

According to a Juniper Research study, Virtual Cards — The Future B2B Solution, the global value of vCard payment transactions is predicted to reach $6.8 trillion in 2026, up from $1.9 trillion in 2021, and 71% will be B2B transactions.

Pros

- Earn cash back — Credit cards aren’t the only game in town that’ll give you cash back. Paying your produce vendor and earning cash back at the same time is a game-changer. The more vendors you pay, the more you earn.

- Enhanced security — vCards are randomly generated numbers for a single or multi-use card. It’s a disposable number that protects your account information so you can rest easy as you make online vendor payments.

- Control — You have control over many factors, including how much is spent and where and when the card can be used, from corporate travel, electronic accounts payable, and mobile payments. The Ottimate card allows you to quickly change limits on any card at any time.

- Cost-effective for paying vendors — vCards allow you to set up automatic payments sent right to your vendor. That reduces the cost of paying staff for their time spent paying vendors.

- Accounting and monitoring made easy — With accounting sync, GL mapping, and one-day settlements, a vCard (like the Ottimate Card) minimizes manual data entry and ensures a smooth reconciliation process. You can also set up email notifications on cards you’d like to monitor in real-time.

- Fast processing — With immediate, electronic payment with a vCard, your vendors are paid on time or early (which can open the door for an early-payment discount request)

Cons

- Not every vendor accepts them — Some of your vendors just might not be set up for electronic payments yet. These are becoming few and far between, but it’s still a possibility.

ACH

An ACH payment transaction is processed by bank or credit union members through the Automated Clearing House and regulated by Nacha, which governs it.

Direct payment through ACH is when funds are used to pay your vendor directly out of your business checking account and are typically deposited into your vendor’s account within 1 to 3 business days.

It’s a solid way to pay your vendors. In 2020 alone, over 4 billion B2B payments were made.

Pros

- Low cost — ACH costs less to process than traditional paper checks. There aren’t printing or postage costs with ACH.

- Better security — When payments don’t pass through human hands, incidents of fraud are drastically reduced. Another security bonus, your payments have to pass through clearinghouses that enforce rules and regulations.

- Efficient for high transaction volume — ACH payments reduce processing time. For high volumes of B2B payments, ACH transactions win the efficiency award over traditional paper checks or wire transfers. And they get vendors paid faster, strengthening business relationships.

Cons

- Geographic limitations — One major drawback of ACH transactions is that the ACH network is only available in the United States. There’s no “global” ACH standard. However, if you have a restaurant in the U.S. odds are most of your vendors are too.

- Transaction speed — While ACH payments are automatic, they’re not instantaneous. Remember, because banks and clearinghouses process payments in “batches,” it takes 1 to 3 days for your vendor to receive their payment.

- Limited options for transaction reversal — Customers can only dispute charges for 3 reasons:

- They never authorized the transaction, or they revoked authorization.

- The transaction was processed on a date that was earlier than authored.

- The transaction was for a different amount than the one authorized.

To dispute a charge, the account holder must notify their bank in writing within 60 days of the payment.

Checks

Checks have been around the US for centuries and are considered the “traditional” way to pay your vendors. Checks are valuable financial tools and, at times, still make sense to use as a payment method.

However, let’s address the two ways to use checks as a vendor payment option.

The first is to hoist out your bulky black business checkbook that looks more like a Trapper Keeper from the ’80s (remember those?). Next, handwrite each check, then stuff it into an envelope, seal and stamp the envelope, walk it to your mailbox or post office and cross your fingers that it makes it to your vendor by the due date.

With the available digital technology today, the above option is costly, labor-intensive, and, frankly, unnecessary.

The second way to use checks as a vendor payment option is automated check processing. You get all the benefits of paying with a check, minus the hassle.

If you automate your accounts payable with Ottimate, they offer automated check processing as a way to pay your vendors. They’ll let you cut a check, then print and mail it for you with a few clicks of a button.

Pros

- No convenience fees — Because paying vendors with checks is pretty straightforward, you skip paying any convenience fee. So whether you issue a check through your bank online or your AP automated system, it comes free of charge.

- Widely accepted — Most vendors still take a good old check. It was the OG meeod of payment forms instead of cash, and pretty much every bank account in the US is set up to receive their deposits.

Cons

- Checks aren’t cheap — If you use automated check processing, you won’t incur printing or mailing fees. However, if you bounce a check, it’s going to cost you big time. Just one returned check can cost anywhere from $20 to $40. Your bank will charge you an overdraft fee, and your vendor may charge you a fee as well. (Not to mention that dings your credibility & trust with your vendor)

- Longer processing time — Automated check processing still involves printing and mailing your check. And that takes time. Mail delays also increase processing time.

- Check fraud — These days, physical products being touched by human hands are more susceptible to fraud. Your check in the wrong hands puts you at risk with your financial info right there for a thief to see.

Automated Invoice Processing Streamlines the Vendor Payment Process

Automated invoice processing streamlines your vendor payment process. This enables you to take advantage of the best way to pay vendors using a vCard payment.

Once your restaurant is ready to move to automated digital payments, it’s time to get prepared.

How to Implement Digital Payments

First things first, when transitioning to automated invoice processing, you’ve got to get your AP department ready to be fully digital.

Follow these simple steps and you’ll be set:

- Digitize & load all invoices

Ditch those paper invoices in favor of digital versions. Digitize all of your existing paper invoices and load them into your automated accounts payable system. Be sure to ask your vendors about sending electronic invoices in the future. **Remember, zero-touch leaves less room for error.**

- Confirm your vendors accept digital payments

Many vendors already accept electronic payments because of their efficiency and speed. They get paid faster! Cash flow is critical for many suppliers to keep daily operations running without a hitch. Get those vendors set up in your AP software. However, if you have a holdout, be prepared to explain the benefits to them of accepting digital payments.

- Use a virtual card to get cash back

vCards are hands down the best way to pay vendors, thanks to their many benefits. Cash back is a big one. In business, every dollar counts, and that goes double for the restaurant industry, where the average restaurant profit margin is a mere 6.2%. A vCard that offers cash back can give that margin a boost.

If you’re not using a vCard as a vendor payment option, you’re leaving money on the table.

Making the transition to digital payments will revolutionize your invoice payment process. Your AP team will thank you.

Choose Your Vendor Payment Option Wisely: vCard Payment vs. ACH vs. Check

Your relationship with your vendors is precious. They’re the lifeblood of your restaurant. Without their products delivered consistently and on time, you’re dead in the water.

Finding the best way to pay your vendors is not only crucial for that relationship, it’s essential to choose the best option for you and your AP operation.

While ACH and checks both have their merits, the vCard payment comes with more benefits than those two combined and is clearly the best option for paying your vendors.

Ottimate’s VendorPay supports all 3 and can help you automate and streamline your vendor payment process. To see VendorPay for yourself, either as a buyer or a customer, request to see a demo of Ottimate.

Stay up to date on the latest news in AP automation and finance

Related