Benefits of a Corporate Debit Card for Your Restaurant

by Jacob Statler

As thrilling as the restaurant business is, it also comes with unique challenges in expense management. And those challenges can snatch away the thrill of running your restaurant faster than a toupee in a tornado. With a corporate debit card, expense management becomes a breeze.

Expense management includes promptly paying your vendors, which is a must if you’d like to continue receiving your supply deliveries. Those consistent deliveries are the lifeblood of your business, and if they get put on hold because a check got lost in the mail, it can be catastrophic for your restaurant. And how about your employees that need to be regularly reimbursed? Rather than wading through a mountain of expense reports, routing them for approval, and issuing paper checks, you could simply use a corporate debit card.

We’re all about the 3 S’s: Simple. Straightforward. Streamlined.

And a corporate debit card hits all 3.

In this article, we’ll cover:

- What is a corporate debit card & how do they work?

- What is the difference between a corporate debit card & a corporate credit card?

- Advantages of using a corporate debit card

- Why should you use a corporate debit card?

- How to choose the right corporate debit card for your restaurant

- Streamline your way to success

Clutch Coffee, a fast-growing coffee chain, began utilizing the Ottimate Card after CFO Jake Vandermeer decided its employee expense tracking software was daunting and inefficient.

Most corporate cards out there don’t work for us because of stringent cash balance requirements. Ottimate’s debit cards are way simpler. I can issue one with a single click, control the card’s rules myself, and monitor all of my purchase activity in real time.

What Is a Corporate Debit Card & How Do They Work?

Corporate debit cards are payment devices that can be used for your restaurant’s expenses. The card subtracts expenses directly from the balance of an FDIC-insured business bank account.

And because the funds for debit card expenditures are pulled directly from your business checking account, they’re an excellent option for managing your restaurant’s expenses without accruing debt or paying interest.

Corporate debit cards can be used in place of paper checks to pay your vendors. This significantly increases the speed of the payment process by eliminating the lag time associated with paper checks.

Corporate debit cards can also be issued to employees for use on business expenses such as supplies, travel, and meals, which scraps the need for a reimbursement process.

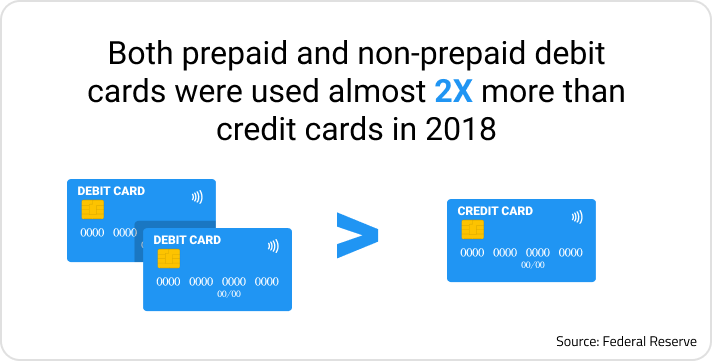

The use of corporate debit cards has been on the rise in recent years. According to the 2019 Federal Reserve Payments Study, debit cards, including both prepaid and non-prepaid, were used almost twice as often as credit cards in 2018, and the number has steadily increased.

What’s the Difference Between a Corporate Debit Card & a Corporate Credit Card?

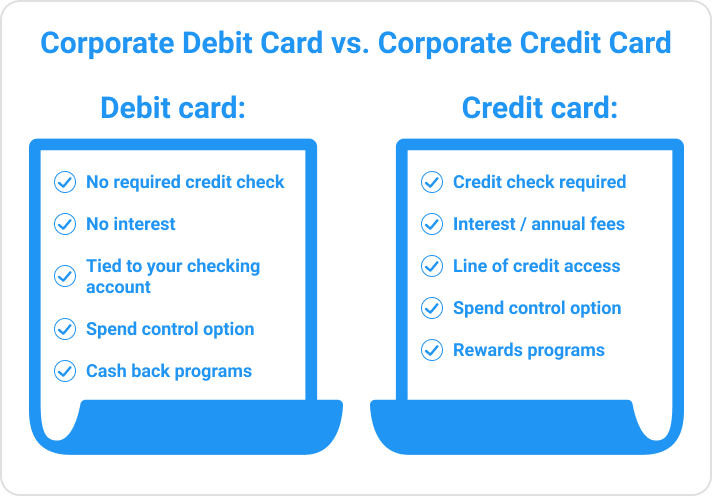

Knowing the difference between a corporate debit card and a corporate credit card is the first step in determining which option is best for your restaurant. We’ve laid out the main features below.

Corporate debit card features:

- No required credit check

- No interest

- Tied to your checking account

- Spend control option

- Cash back programs

Corporate credit card features:

- Credit check required

- Interest / annual fees

- Line of credit access

- Spend control option

- Rewards programs

4 Advantages of Using a Corporate Debit Card

Corporate debit cards are a quick, simple form of payment, with the bonus of costing less than the use of paper checks. In addition, they’re convenient for everyday expenses because they can be used for purchases made online, in person, and over the phone.

Corporate debit cards can streamline and simplify your vendor payments, employee spending, and employee reimbursement process. In addition, a debit card enables you to manage your restaurant’s expenses in a straightforward, uncomplicated manner.

Here are some of the top advantages of a corporate debit card:

Keeps You on a Budget

You can control daily and monthly spending limits on a corporate debit card. For example, if an employee has a $200 recurring monthly parking charge, you can fund the card for $200 and specify it for parking use only.

No Interest and Lower Fees

There’s no interest or high fees because corporate debit cards tap funds directly from your restaurant’s business bank account.

As a restaurateur, you’re well-acquainted with the fact that your profit margin dictates your success. With that in mind, eliminating the unnecessary expense of interest and annual fees is a wise business decision toward the goal of operating in the black.

Security

It’s important to know that since corporate debit cards deduct funds from your bank account within one day of the transaction, you’ll likely lose access to those funds if fraud occurs.

In most cases, you’ll be able to work with your bank to recover these funds, but unlike a credit card, you won’t be able to use these funds until the recovery process is complete.

However, most modern corporate expense programs that use debit cards come with a host of spend controls that prevent fraud from happening in the first place. These include:

- Virtual cards that are only usable at specific merchants, have specified transaction amounts, or spend categories.

- Physical cards that have pre-loaded approval policies.

- Single-use virtual cards for online transactions that cannot be used again.

Easier To Obtain Than a Corporate Credit Card

No credit check is required for a corporate debit card.

Your credit history and credit score aren’t a consideration, whereas credit cards require institution approval. A corporate debit card enables you to streamline your expense payment method without subjecting your business to financial scrutiny.

When using a debit card, like the Ottimate card, you can issue cards on-demand from within the card platform — no need to contact your bank and wait for them to issue and mail your cards.

What To Know Before Getting a Corporate Debit Card

Using a corporate debit card is a simple option to streamline your expense management, no doubt. However, there are a couple of things to know before you jump into the deep end of the debit card pool.

Debit card fraud protection is based on pre-set spend controls. It’s crucial to set up your controls ahead of time (rather than after the fact as with a credit card). Setting up spending limits and approved merchants allows you to take full advantage of the fraud protection a corporate debit card allows for.

Debit cards pull funds from your bank account rather quickly. Most corporate debit cards debit the funds from your bank account immediately or within 1 business day after the transaction. So keep that in mind.

Why Should You Use a Corporate Debit Card From Ottimate?

To ease the burden of managing expenses and simplify your payment process in the fast-paced restaurant industry, swap out using cash, checks, or credit cards for a corporate debit card.

All corporate debit cards aren’t created equal, and you certainly want the card with the most to offer. When choosing a corporate debit card, these key features will help streamline your accounting processes in addition to providing convenience:

- Cash back program

- Ability to instantly issue cards

- Unlimited amount of issuable cards

- No minimum bank balance required

- Employee expense reimbursement support

- Granular spend control

- Option for burner cards, subscription cards, and reloadable cards

- Automatic transaction mapping

- Automated mileage tracking

- Instant transaction notifications

- Mobile capture and AI-powered receipt matching

The Ottimate Card offers all of these features to help streamline your expense management and make your end-of-month reconciliation a breeze.

The Migration To Prepaid Debit Cards for Business Expenses

With the new era of digitalization, prepaid debit cards are an excellent way to manage restaurant expenses and eliminate the need to reimburse employees.

A prepaid card can be loaded with a set dollar amount, enabling your employee to make necessary purchases without dipping into their personal finances. In addition, employees don’t have to wait to be reimbursed, which can boost staff morale.

Using a prepaid debit card gives you more control over employee spending. You can lock or unlock a card anytime, set spending limits, control use by location, and set up instant transaction alerts on your smartphone or computer.

Utilizing prepaid debit cards in your restaurant operation can ease your mind in several ways:

- Your credit score won’t prevent you from qualifying

- Ability to better manage your business’ spending

- You can set limits on employee spending

- No overdraft fees

- Easy to use and reload

- No need to reimburse your employees

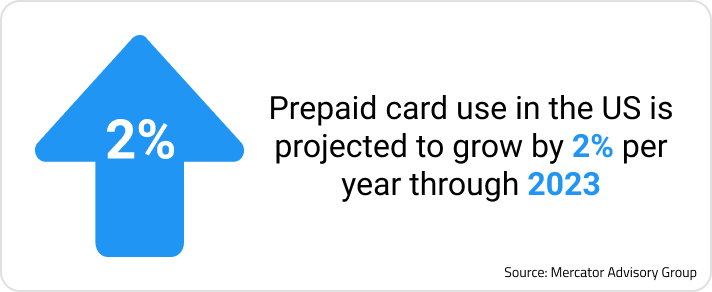

The use of prepaid debit cards is on the rise. A report by Mercator Advisory Group projected that prepaid debit cards in the US will grow by 2% per year through 2023.

How To Choose the Right Corporate Debit Card for Your Restaurant

You’re sold on the idea of a corporate debit card. Now let’s address how to choose the right one for your business.

Here are some essential features to require in your corporate debit card:

- Rebates — The ability to earn rebates on your purchases is a crucial element in putting money back into your restaurant’s budget.

- Ability to issue numerous cards — You must be able to issue cards to all staff members that make purchases for your business. This is essential to streamlining your payment processes.

- Ability to change limits on cards — Eliminate employee overspending with the option to adjust spending limits on each staff member’s card.

- Virtual card option — A virtual card is a 16 digit number issued to be used as a debit card. It boasts all the conveniences of a debit card without the plastic. Virtual card use is on the rise for businesses looking for better ways to manage company spending.

Streamline Your Way to Success

In the restaurant business, streamlining operations increases your profitability, which directly affects the success of your restaurant.

And we all know what success looks like — full tables of happy customers day after day or night after night.

Your goal of success should include improving back-of-house operations like strengthening your internal accounting controls, increasing employee satisfaction, and building better vendor relationships.

Utilizing a corporate debit card or virtual card for those improvements is your roadmap to success.

Stay up to date on the latest news in AP automation and finance

Related