How To Automate Vendor Bill Payments

by The Ottimate Editorial Team

Are you still using a manual system to track and pay vendor bills? You may be wasting precious time — and eating into your profits.

If you’re looking for a way to streamline your accounts payable tasks, there’s a simple solution: automated vendor payments.

What is payment automation?

Payment automation is the use of technology to automate the process of paying your vendors. By automating your payments, you not only save time and eliminate errors, but you also gain more control over how and when your vendors are paid. This makes managing your finances simpler and gives you more time to focus on other important work.

Payment automation offers many benefits, including:

- Creating consistency across your business

- Saving money by leveraging early payment discounts

- Reducing the risk of both internal and external B2B payments fraud

- Improving control and visibility of your payment and vendor information

- Shifting time previously spent on manual processes to other essential tasks

Challenges of Manual Bill Payment

The accounts payable process can be overwhelming on its own. But it can become even more so if you’re relying on a manual process to pay your vendors.

Manual processes come with their own set of challenges, which create issues for you and your team.

For instance, a manual process typically means piles of paperwork. Loose papers are easy to lose or misplace, and you may find yourself spending hours slogging through a sea of paper invoices. And manual accounting is susceptible to human error, which can result in late fees and strained relationships with vendors. Even small mistakes can have significant financial consequences.

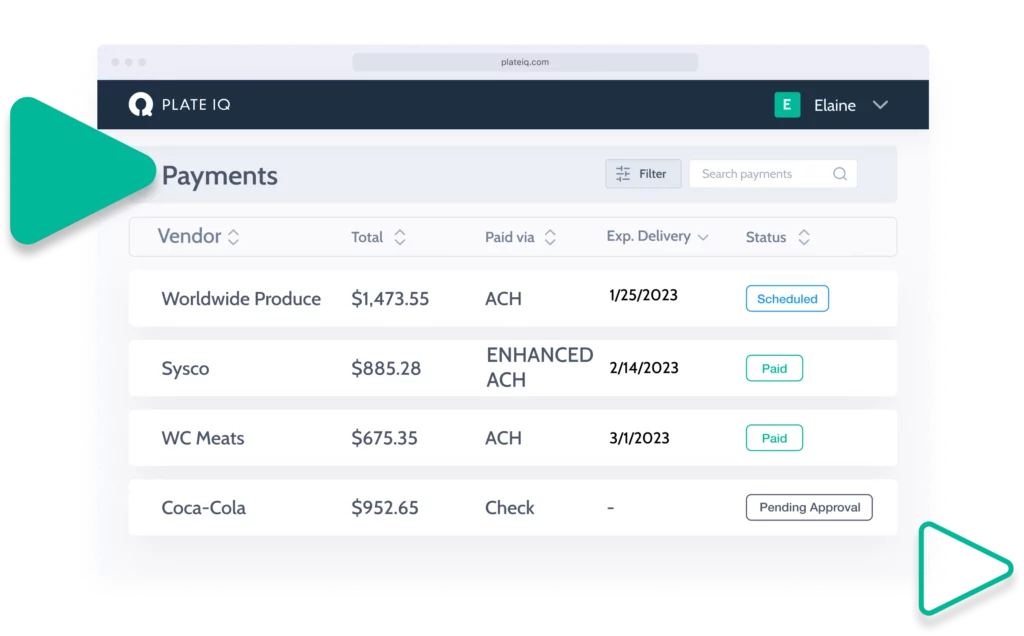

It’s also likely that each of your vendors has their own unique payment terms and preferences. Some vendors may prefer virtual card payments, while others require ACH bank transfers or checks. This means that not only do you have to process multiple payments, but you’ll also need to keep detailed records of how each vendor prefers to be paid. An automated payment solution accurately tracks this information for you, making it easy to track each vendor’s needs — without putting in extra time or worrying about potential errors.

Benefits of Automated Vendor Payments

Online bill pay software systems, like Ottimate’s VendorPay, offer an efficient way to manage vendor bills quickly and accurately.

With a software solution, you can easily access original vendor bills, purchase orders, and invoice numbers while staying organized. This streamlines your workflows, so you can focus on more crucial tasks — like providing a top-notch client experience or offering professional development opportunities to your staff.

Moreover, payment software reduces the risk of human errors. With automated payments, you don’t have to worry about missing due dates or incurring late payment fees.

Automated payment services can also help in generating tax reports, making year-end financials a breeze. Plus, you can access comprehensive insights into your payment history, so it’s easy to track your spending throughout the year.

Expense Management: Another Benefit of Payment Automation

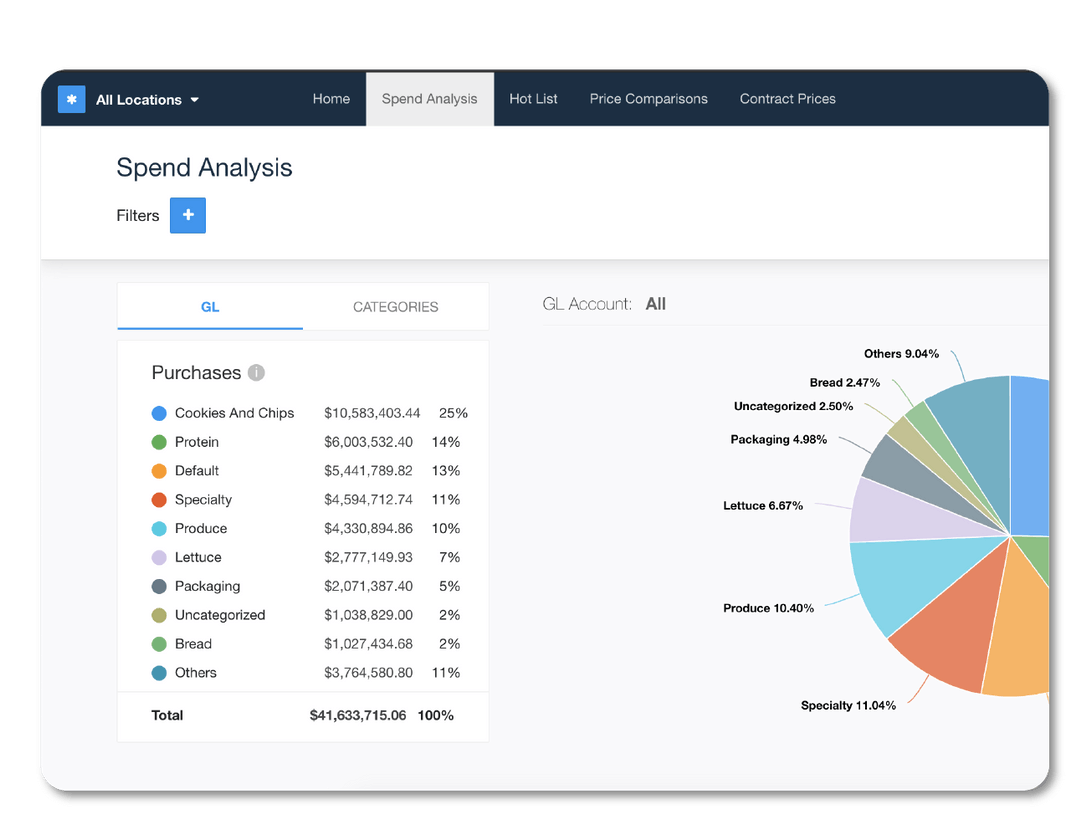

Another benefit of using an online service to pay your bills is the ability to track your expenses over time. Online records give you a big-picture summary of your spending.

Using an expense management solution, like Ottimate’s Spend Management, helps you manage cash flow and optimize spending with the click of a button. Unlocking these insights can help you identify actions that save money, improve payment processes, and monitor spending.

Automate Vendor Payments with VendorPay

A manual accounts payable process can be a hassle — especially when it comes to paying your bills. Manual bill payment not only takes up significant time, but also puts you and your business at a higher risk for errors. By switching to an automated vendor payment system, you can save time, eliminate errors, and even manage your spending better with high-level insights.

And with Ottimate’s VendorPay, you’ll never have to slog through piles of paper bills again. VendorPay gives you the power to make payments, view your spending, and customize your payment options — all from a single, easy-to-use platform.

You can choose from various popular payment options through Ottimate, including:

- ACH transfers

- Virtual credit cards (or vCards)

- Checks

Our intuitive AP automation system maintains searchable records of all your invoices, down to each line item. So when you pay an invoice through Ottimate, you can submit it for approval and schedule payments with accuracy and ease.

Ready to leverage the power of payment automation? Schedule a demo today!

Stay up to date on the latest news in AP automation and finance

Related