From Clay Tokens to Artificial Intelligence: A History of the Invoice

by Jillian Straw

As invoice and history geeks at Ottimate, we spend a lot of time thinking about how invoices have evolved through time. The invoice is one of the oldest document formats we have – probably the first form of written communication ever used. While often overlooked, it has an outsized impact on the economy, as businesses transact more than ever with each other.

The story of the invoice begins in the ancient city of Uruk, a civilization that rose upon the banks of a channel of the river Euphrates in Sumer (now present day Iraq). Uruk is the capital city featured in the Epic of Gilgamesh – regarded as the earliest surviving great work of literature.

“He built the town wall of ‘Uruk,’ city of sheepfolds. Look at its wall with its frieze like bronze! Gaze at its bastions, which none can equal!”

– The Epic of Gilgamesh

The epic’s protagonist, Gilgamesh was the king of Uruk.

Archaeologists studying ancient Sumer were mystified by a discovery of little clay objects strewn about the ruins of Uruk and other Mesopotamian cities – conical, spherical and cylindrical tokens.

One archaeologist, Julius Jordan, wrote in his journal, “that they were shaped like the commodities of daily life – jars, loaves, and animals” – although they were stylized and standardized.

No one could figure it out until another archaeologist, Denise Schmandt-Besserat, discovered that the tokens had a simple purpose: correspondence counting. Tokens shaped like loaves were used to count loaves. Those shaped like jars counted jars.

Correspondence counting is easy: you don’t need to know how to count, you just need to look at two quantities and verify that they are the same. These tokens could also be used to track lots of different quantities, as well as addition/subtraction.

Remember, Uruk was a great city, an urban economy. Running an economy requires trading, and taxation.

It requires accountants.

Picture the Uruk accountants, sitting at the door of the temple storehouse, using little tokens to count sacks of grain that enter and leave the grand storehouse doors.

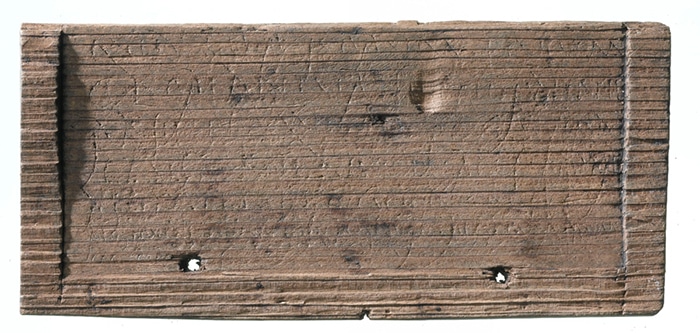

Denise Schmandt-Besserat pointed out something else. The abstract marks on the cuneiform tablets also found in the ruins matched the tokens. Everyone else had missed it because the marks didn’t look like anything.

What’s really interesting is that the tablets were used to record the back-and-forth of the tokens, which themselves were recording the back-and-forth of sheep, grain, and jars of honey.

Eventually, those accountants realized that it was simpler to use stylii to make these marks, instead of tokens. Thus, cuneiform writing was born – as a way to represent a token, representing a commodity.

Those clay tablets weren’t being used to write great literature or holy scripture.

They were used to create invoices: a record of what was supplied and a record of a future obligation to pay.

The Invoice Today: Data vs. Dated

Invoices have evolved quite a bit since stone etchings. They contain detailed information that — together with other invoice data across time, across locations, and even across line-items on the same invoice — tell a story of their own.

Invoices today come in primarily two forms: electronic data and paper.

For businesses with electronic data interchange (EDI) feeds from their vendors, an invoice is simply data transferred at the speed of light from the vendor to the client’s invoice system. The lack of manual input means near-zero human effort in exchange for near-perfect data. Though these invoices have the same lifecycle as paper invoices, they process much more cleanly and quickly.

Paper invoices, on the other hand, require a lot of intervention. These invoices — not too far removed from pieces of stone, in reality — account for about 90% of the cost of processing payments.

That cost is incurred by the processing a business needs to do to turn a piece of paper into a settled transaction: a process we call the invoice life cycle. Here’s what exactly that entails.

Understanding the Lifecycle of an Invoice

Step 0: What is an invoice?

An invoice is a business document that requests payment for specified goods or services rendered to a customer.

Unlike a receipt, which details a transaction that has already been resolved, an invoice is a bill that sets out terms for the requested payment. It also lists what was sold and for how much. Here’s what the invoice needs to include:

- The parties. Who is selling and who is buying. Precision is important here. If there’s ever any arbitration surrounding who exactly owes who exactly money, the specific parties matter.

- Bill of goods / services. The invoice needs to state clearly what was purchased, unit cost, totals, and ideally, some sort of identifier for each line item.

- Date. Invoices are documents asking for money to be paid in the future, which means time is an essential feature of the invoice life cycle. The date is the starting point for the…

- Payment terms. These are the rules (often negotiated) for when and how the vendor will be paid. Terms often include the number of days within which full payment is due, and sometimes the discount the vendor will offer for full payment by a certain, earlier date.

“Net 20” means full payment is due 20 days after the invoice date.

“2/10 Net 30” means the buyer will receive a 2% discount if they pay within 10 days, but the nominal amount is due in 30 days.

Anything pertaining to interest or overdue fees should also be stated on the invoice

- Invoice number. Something to identify the document in the vendor’s and the customer’s records.

- Signature. Not essential, but something many invoices have to signify proof that the receiving party did, in fact, get the goods and the invoice covering them.

Step 1: Invoice receipt

The life cycle of an invoice begins when a vendor generates an invoice for a client detailing a transaction for which they’ve provided goods or services. Typically, there are four ways vendors send invoices to customers:

- EDI (Electronic Data Interchange). Larger vendors sometimes send their clients invoices electronically to avoid the hassles of paper.

- Email. Many vendors email PDF copies of their invoices directly. It would then fall on the client to stay up to date with their inbox.

- Physical (Snail) Mail. When receiving paper invoices weekly or monthly some vendors may choose to go through the process of mailing out their invoices to clients. Followed by hoping there is no delay in mail service.

- Hand Delivery. Some orders get an invoice sent with the companies’ delivery representative. Whether that’s for COD orders or otherwise, the invoice would then be verified by the client to match the delivery, signed, and filed away.

Step 2: Processing the invoice

Because so much invoicing is done on paper and PDF, managers, account owners, or account payable clerks spend significant amounts of time reading, verifying, and entering the invoice details into their accounting systems.

First they have to make sure all the items match what they ordered (matching the invoice to the purchase order), and that the invoice matches what is received (matching the invoice to the packing slip).

Step 3: Approving payment

Once verified, the invoice then has to be approved for payment. This alone can take anywhere from hours to days as approvers are hunted down and their questions are addressed.

Step 4: Accounting the invoice

After being approved, the invoice lands in the hands of the bookkeeper. It’s now up to them to record these transactions in the company’s books for later reconciliation.

An important aspect of this part of the invoice life cycle is to code each individual line item to the correct account on the general ledger (GL). Not all invoices list items that belong to the same account; in industries that deal with large invoices listing diverse contents, such as restaurants, this is a common situation.

Capturing all of this accurately is an incredibly expensive endeavor. Even with ample time and highly accurate invoices, human errors happen all the time. The curse of manual data entry means that a fatigued bookkeeper, or a distracted chef may accidentally key in an extra zero or code to the wrong GL causing random errors.

Random errors are much harder to track down because they are not systemic (i.e. solving the systemic cause fixes everything). Random errors means that they have to be rectified manually, adding even more cost to an already expensive process.

Step 5: Paying the invoice

The life cycle of an invoice ends when the vendor gets their money, whether by check, credit card, or directly through ACH. Violating the vendor’s due date can lead to delays or cancellations in future service.

Strategic Analysis

After the invoice’s life cycle is complete, it’s important for businesses to keep learning from them. Invoices are snapshots in time and space that, strung together and viewed holistically, paint a picture of a business’s cash outflow. Detecting ripples in those trends and optimizing for their stability is an important asset to any finance team.

With the accounting team already keeping track of approvals, coding, filing, and due dates, that doesn’t leave much time to dig into the information that’s stored away in each of those invoices — whether the team is from a major accounting firm providing bookkeeping services to their clients, or a restaurant keeping an eagle eye on food costs to protect their already razor-thin margin.

Even if the accounting time had the time to dig into and analyze/compare individual line items, chances are the data could be stale and would only be useful as a lagging indicator, which minimizes the opportunity to course correct.

Ottimate Brings Sanity to Accounts Payable

Automating accounts payable is the next evolution of the invoice. A simple tool that started out as clay tokens, can now be represented and processed in digital format with artificial intelligence.

The process is fairly straightforward: Since most invoices are printed in fairly consistent formats, Optical Character Recognition (OCR) technology, combined with state-of-the-art artificial intelligence can now read, process, and accurately capture invoice data into accounting systems.

With technology like Ottimate, invoices can be received, converted into digital format, coded to the right GL codes and exported to any accounting system. When combined with a payment network like Ottimate’s Bill Pay, an invoice can be processed, paid and accounted for in minutes, not weeks.

“I envision a world where the lifecycle of an invoice—from the vendor sending it to paying it to reconciling it—is completely transparent; Restaurants wouldn’t have to lift a finger or wonder about the data.”

-Ram Jayaraman, CTO and Co-Founder of Ottimate.

Stay up to date on the latest news in AP automation and finance

Related