B2B Payment Automation: The Future of AP Processes

by Maddy Osman

With any business comes administrative tasks that you would, well, rather avoid.

And paying supplier bills? That tends to land pretty high on everyone’s “what I’d prefer not to do today” list. So it’s no surprise accounts payable (AP) workflows tend to become a drag on your business.

According to Bottomline, invoice processing and accounts payable are two of the most inefficient components of B2B financial operations.

With a plethora of B2B payment automation solutions available, there’s no reason for business payments to be such a tedious process. The good news is that setting up an automation once can actually remove the majority of those time-consuming manual tasks that made accounts payable so frustrating in the first place.

Keep reading to discover how accounts payable automation can help you increase efficiency, reduce costs, and protect your business’s financial information.

Here’s what you’ll learn:

- Top AP Challenges for B2B Companies

- The Future of B2B Payments

- How B2B Payment Automation Works

- Benefits of B2B Payment Automation

- Final Thoughts: B2B Payment Automation — The Future of AP Processes

Top AP Challenges for B2B Companies

While most B2B businesses have begun using electronic payment methods, 36% still use checks as their primary payment type for most of their vendors.

Even companies that use electronic payment methods struggle to optimize their processes and consistently make payments on time. Specifically, B2B companies struggle with managing their vendors’ bank account information, missing vendor information, and lost or incomplete invoices.

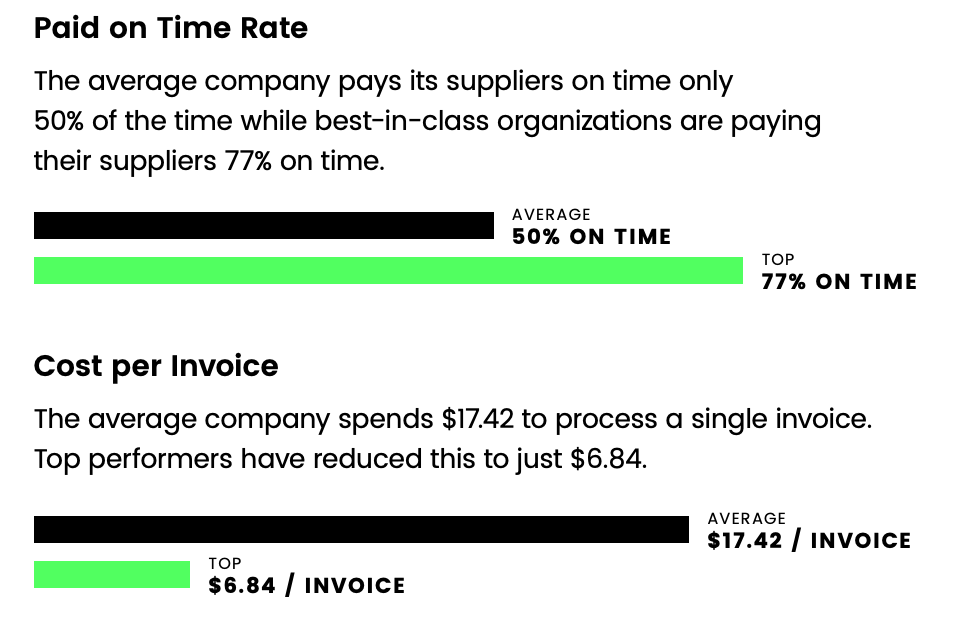

According to Celonis’ State of Business Execution Benchmark Report, the average company pays vendors on time only 50% of the time and spends $17.42 to process each invoice. On the other hand, top performers make on-time payments 77% of the time and only spend $6.84 per invoice on average.

To improve invoice management and accounts payable processes, B2B companies must embrace new technologies and look for ways to eliminate organizational silos that slow them down.

The Future of B2B Payments

Gone are the days of paper invoices and mailing check payments. Businesses have finally decided that traditional payment methods just don’t cut it anymore.

Here are the top trends influencing AP workflows in the business-to-business world.

B2B Digital Payments

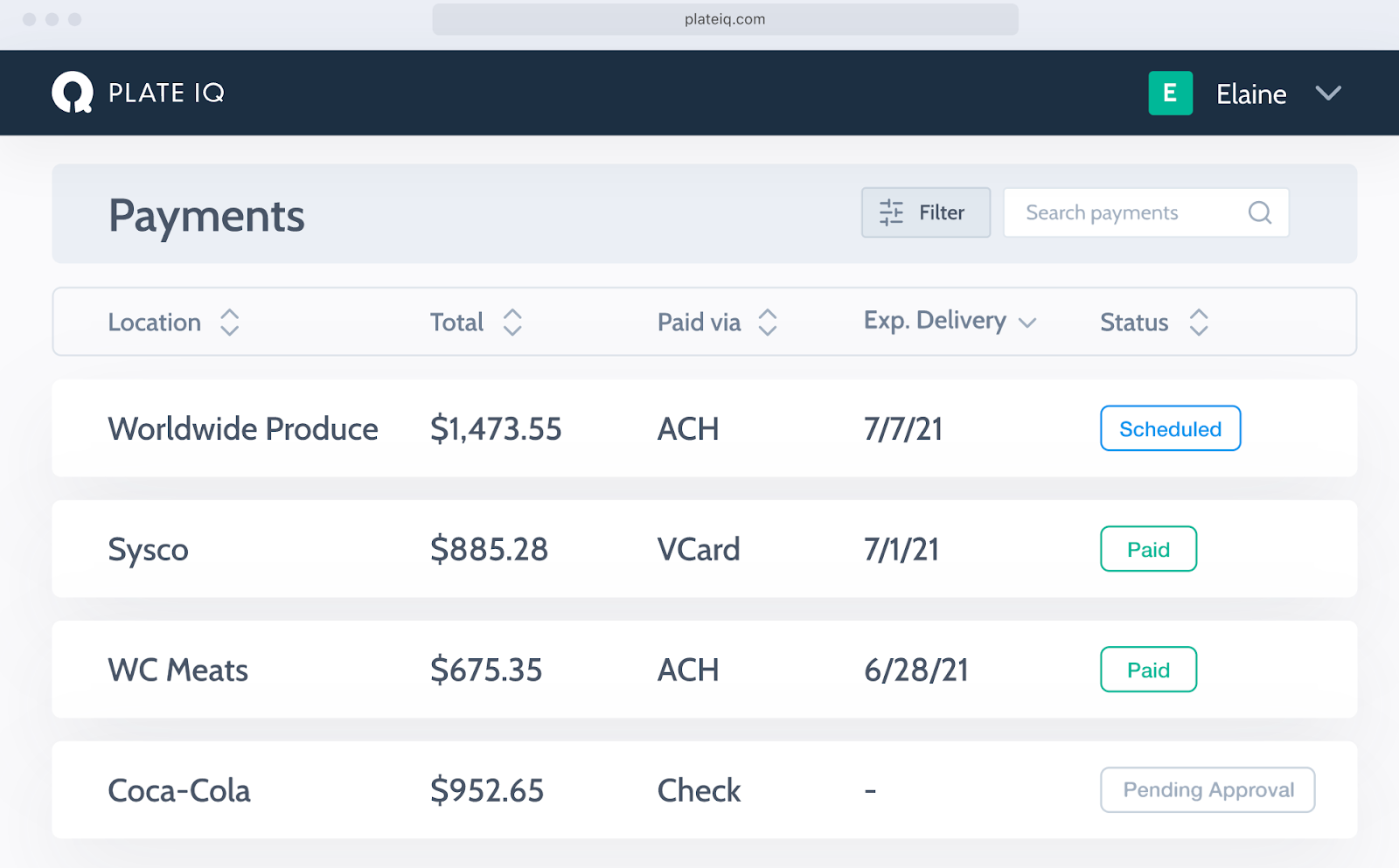

Digital payment options let you pay your suppliers in real-time using ACH payments, credit cards, and virtual card payments. Using digital payments helps you speed up your B2B payment process, improve cash flow, and reduce AP costs.

More AP Automation

B2B payment automation software providers can do more than just automate payments. Companies want integrated technology solutions that can automate multiple AP tasks like invoice processing and approval routing while also integrating with their accounting system.

Increased Demand for APIs

Demand for APIs in AP processes has increased — especially since you can use them to share data and facilitate online payments.

API stands for application programming interface, which is a type of software that lets two applications share information. For example, your AP automation software might use an API to update your accounting software when making payments.

How B2B Payment Automation Works

B2B payment automation refers to the use of software to handle tasks in the AP workflow.

AP automation software can facilitate tasks such as:

- Invoice processing

- Approval routing

- Paying suppliers

- Entering accounting records

- Capturing expense data

Benefits of B2B Payment Automation

Automating the AP process offers several benefits that make it an attractive alternative to manual processing.

Improved Efficiency

Automation speeds up processes like invoice processing and approval routing by eliminating manual data entry and intermediaries.

Using automated B2B payment solutions also lets you take advantage of more efficient payment methods instead of spending time printing paper checks or dealing with legacy payment systems.

Cost Savings

Mailing checks isn’t just slower — it’s more expensive. With payment automation, you can skip the printing and postage costs by paying your suppliers using wire transfers or card payments.

Same-day payment methods help you avoid late fees, make strategic ordering decisions, and even take advantage of early payment or quantity discounts if your supplier offers them. Some AP automation software options, like Ottimate’s VendorPay, also offer cashback incentives when using virtual or physical debit cards.

Better Data Capture

When someone on your team has to manually enter all of your invoice data, there’s an increased chance of human error. But, with AP automation software, you can easily upload invoices from a phone or receive electronic bills directly from vendors with electronic data interchange (EDI).

Optical character recognition (OCR) software can process handwritten data on invoices. AP automation platforms with artificial intelligence (AI) can add spending categories to invoice line items and automatically update your accounting software.

Ultimately, you get more accurate and comprehensive data that you can use to track your expenses and improve cash flow forecasting.

Fraud Prevention

According to Bottomline’s B2B Payments Survey, 49% of businesses experienced serious fraud attempts. Vendor impersonation was the method behind 69% of attempts.

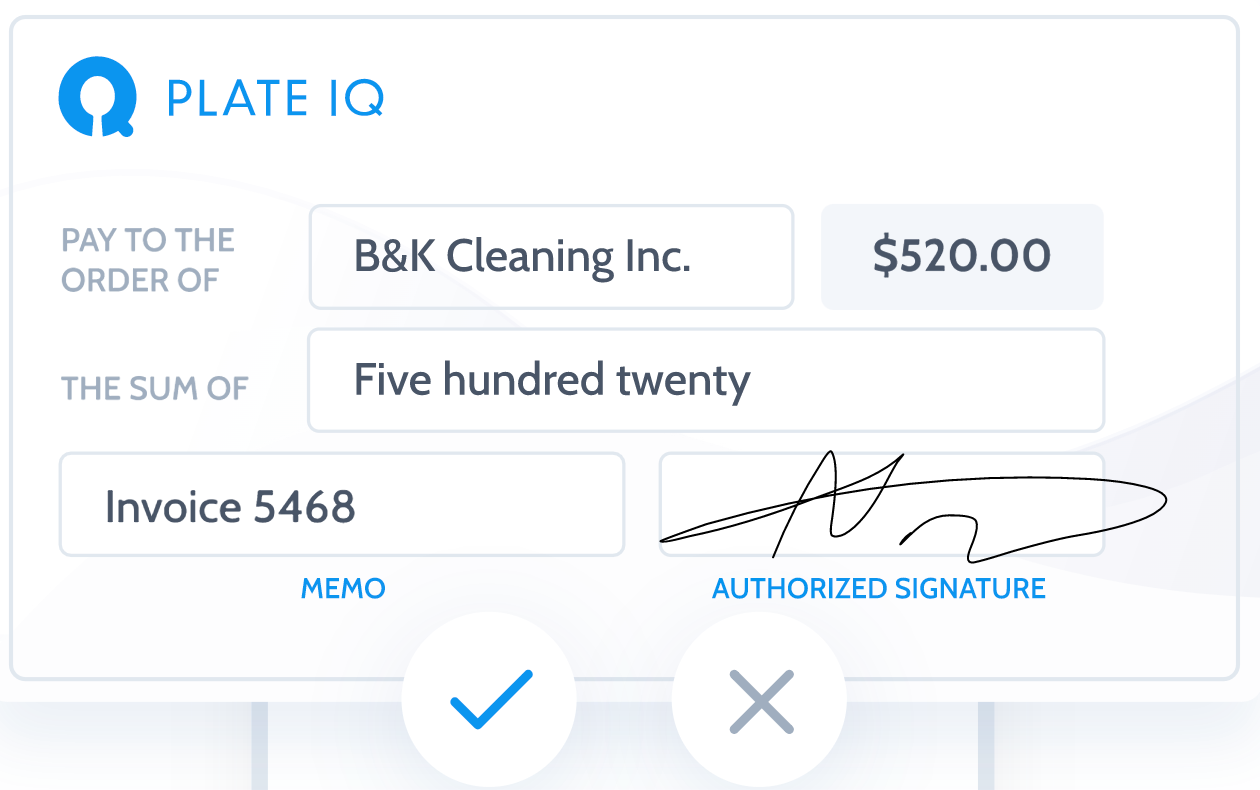

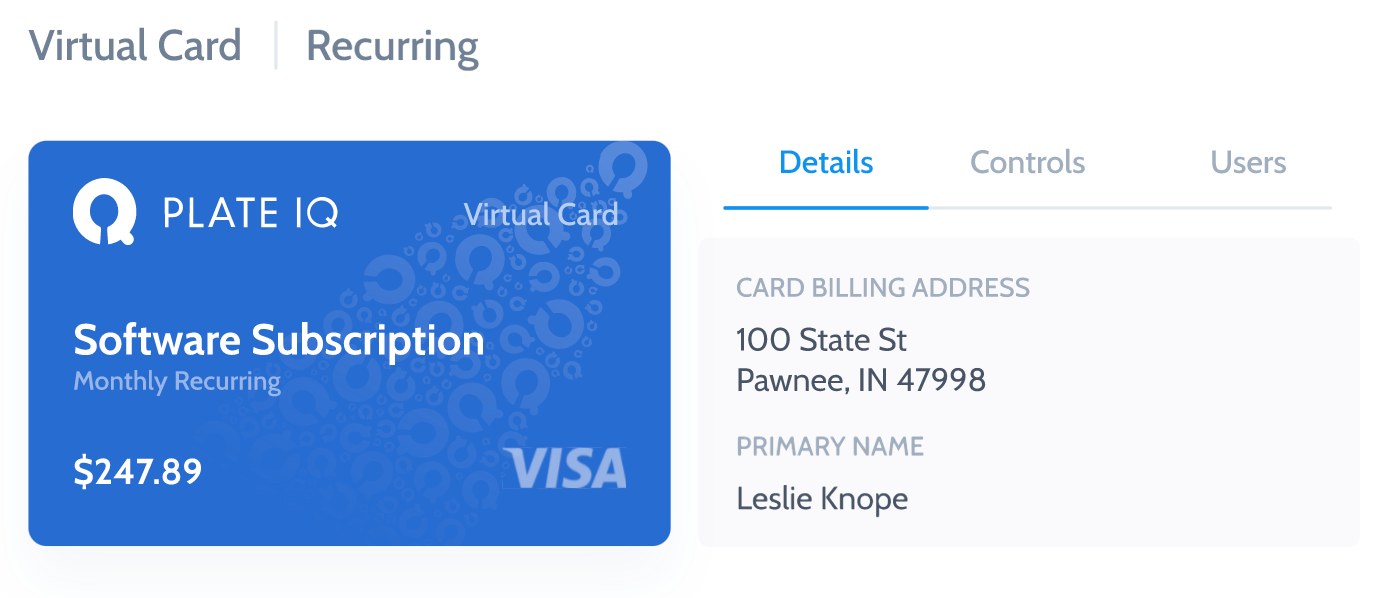

AP automation platforms like Ottimate’s VendorPay network connect you directly with suppliers, which reduces the risk of vendor impersonation. It also gives you the option to use virtual cards that give you more control over where your money goes.

You can opt for single-use virtual cards or set payment rules (such as vendor and amount limits) that protect you from financial loss in case of fraud.

Final Thoughts: B2B Payment Automation — The Future of AP Processes

With the right tools, your AP workflow can serve as a strategic asset. Easy payments aren’t just for end consumers anymore.

Solutions like AP automation and e-payments can streamline your business transactions into a smooth process instead of a clunky set of to-dos. More B2B companies continue to leverage payment automation software to create cost savings, prevent fraud, and boost efficiency.

To learn more about how you can pay all your vendors from a single platform while earning cashback on your expenses, explore Ottimate’s VendorPay network.

Stay up to date on the latest news in AP automation and finance

Related