12 Benefits of AP Automation for Your Private Club

by The Ottimate Editorial Team

AP automation for your private club is the secret sauce for your financial operations to run smoothly and efficiently. No longer will your finance team have to do things the hard way — slogging through the paperwork shuffle and running from office to office hoping to find the right person for invoice approval.

Want to know more about AP automation? We’ll cover:

- What is AP automation?

- 11 benefits of AP automation for private clubs

- Transitioning to AP automation in your club

- Look for cutting edge capabilities in AP automation software

Ottimate offers automation throughout the AP lifecycle to free up your time, increase efficiency, and reduce errors. The Club at Ravenna saved a full day every week using Ottimate to automate their AP processes.

What Is AP Automation?

AP automation (accounts payable automation) is both digitally handling accounts payable and finding ways to automate most manual invoice and accounts payable processes while keeping human input at key decision areas (for example, payment approvals).

The gold standard of AP automation is “ZeroTouch” where no manual data entry is required at all from invoice receipt to vendor payment — the only thing left is approvals.

AP automation has revolutionized the way private clubs process and pay their invoices.

There’s no debate around the fact that private clubs’ accounts payable processes are complex. Your finance manager is responsible for ensuring all invoices are properly authorized and promptly paid.

Even a small AP mistake can cause much more than a slight ripple in your system. These setbacks are not only time-consuming for your management team to find and fix, but costly to your club as a whole and severely disrupt other ordering processes.

AP automation for your private club streamlines and standardizes all accounts payable activities to ensure all departments stick to the same AP structure and make payments on time.

Automation ditches many manual processes of AP. For example, paperless invoice processing allows your vendor invoices to be submitted electronically, approved, and paid without ever physically passing hands.

No more coffee-stained paper invoices, slow approval processes, or late payments.

12 Benefits of AP Automation for Private Clubs

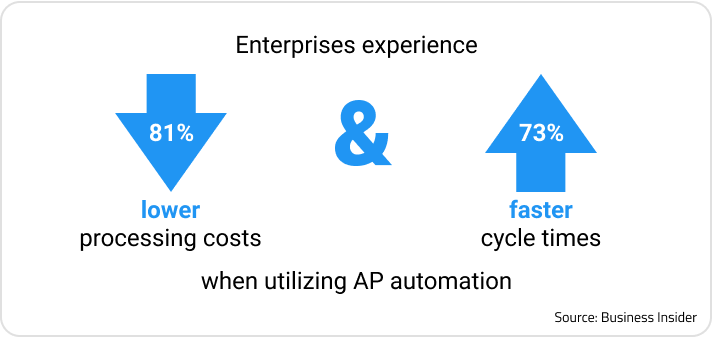

The immediate benefits of switching to automation make the decision a no-brainer. Enterprises experience 81% lower processing costs and 73% faster cycle times when utilizing AP automation, according to 2020 Business Insider data.

Let’s dig further into the benefits of AP automation below:

1. Save Time on the Paperwork Shuffle

Shave a huge amount of time off AP tasks through automation. What was previously slow and repetitive work (checking purchase order forms and entering invoice data line by line) is now done almost instantly.

Country clubs tend to have a huge amount of manually handled paper invoices from multiple departments. Those paper invoices take a large chunk of time to manage. Your club’s workflow will be exponentially faster with AP automation.

2. Lower Cost Invoice Processing

Paper invoice processing is slow and costly — plain and simple. It drains your club’s resources when manual accounts payable procedures require invoice handling, data entry, and reconciliation.

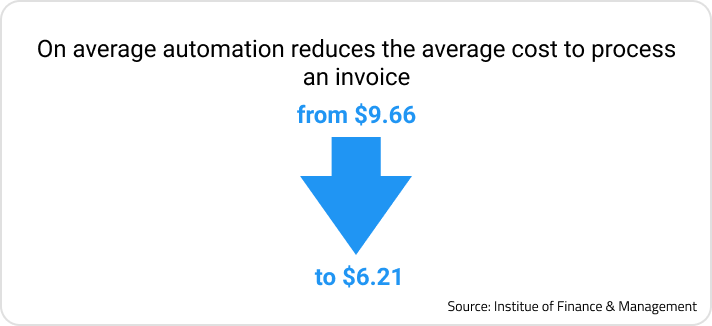

Paperless invoice processing costs less than manual invoice processing. On average, automation reduces the average cost to process an invoice from $9.66 to $6.21. That’s a whopping $3.45 or 36% PER invoice.

3. Faster Invoice Approval Process

Country clubs can have multiple levels of approval (sometimes up to 300 approvers!). Be it a manager who’s out on the green or a board member who’s out of town, AP automation enables automatic and remote invoice approval.

No more waiting for lengthy invoice approval processes. No more hand-delivering invoices to be approved. Electronic invoice approval significantly reduces the time it takes to get an invoice approved for payment.

4. Automatically Split Invoice Items by Department

Country clubs may have invoices that require splitting between departments (since clubs have multiple departments, each with their own P&L). AP automation allows for this to be done automatically which saves the club’s CFO time and increases accuracy.

5. Improved Accuracy

Humans make mistakes. And the more manual a task, the more room for error. For example, some of the most common AP mistakes of duplicating payments, wrong P.O. numbers, incorrect entry of invoice data, or paying for items never received are virtually eliminated with AP automation.

6. Enhanced Insight & Reporting

AP automation entails digitization of all documents, enabling your club’s CFO to quickly and easily access invoices, receipts, and evidence of payment. This allows increased oversight of your club’s operation and its financial health.

Digitally processing and paying invoices makes it easier to close and generate financial reports for the board and enables quicker, more frequent reporting. AP automation essentially makes the country club CFO’s job easier.

7. Fraud Protection

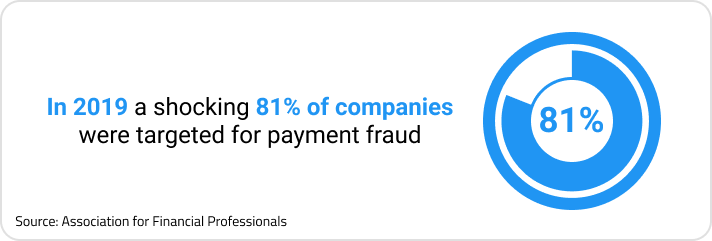

A 2020 AFP Payments Fraud and Control Survey revealed a shocking 81% of companies were targeted for payment fraud in 2019. AP automation levels up your protection against fraud by safeguarding your documents, payments, and standardized processes.

8. Increased Transparency

AP automation boosts your club’s financial transparency. Going paperless means all financial data is available at the click of a button. Your board and your members can be confident that your club’s financial operation is out in the open because it is.

9. Low-Cost Data Storage

Paperless invoice processing means no more dusty boxes of paper invoices. Rather than having to allow (or pay for) space for documentation that needs to be kept, digital document storage lightens the load and the cost.

10. Easy Auditing

Audits are inevitable, but they give you an overall financial picture of your club’s operation. AP automation improves the speed of auditing and reduces the stress of a paper scavenger hunt to get your hands on all necessary documentation.

11. Integration With Existing Systems

Automation streamlines the organization of your entire invoice processing system by seamlessly integrating with your existing systems. This makes for smooth sailing throughout your accounts payable department.

12. Early Payment Discounts

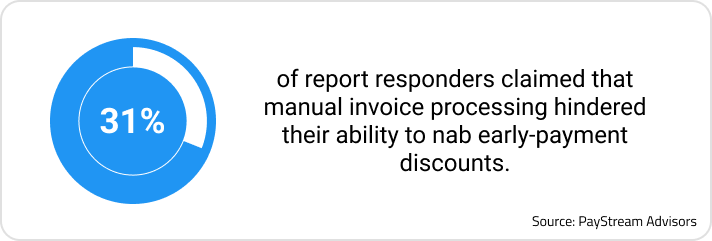

While there’s a boatload of reasons for missing out on these valuable discounts, 31% of responders to PayStream Advisors’ AP & Working Capital Report claimed that manual invoice approval and processing seriously hindered their ability to nab early-payment discounts.

How to Transition to AP Automation in Your Club

Transitioning to AP automation for your private club requires some thinking ahead and planning to ensure the switch goes smoothly. Follow these essential steps for a successful transition.

- Research — Do stellar research to find which platforms integrate best with your current setup — it’s easier to use AP platforms that “drop in” to your current workflows and systems, rather than a system that forces you to rip out your entire system.

- Prep your team — Plan your implementation with your team. Review your current workflows to determine where you need to streamline. Assign responsibilities and delegate tasks involved with the transition. Encourage open communication throughout the process.

- Map out your timeline — Setting a timeline for the transition helps ready your team for the process and be clear on your completion goals. Remember, your club still has daily financial transactions that you must stay on top of while you’re in the transition phase.

- Digitize documents — Ditching paper in favor of digital will be life-changing for your AP processes. Digitizing all documents and uploading them into your AP automation system needs to be delegated.

- Vendor list — Identify and organize your vendor list and try to figure out monthly spend per vendor. This will help you calculate potential savings from available vendor rebates, cash back, etc.

- Notify your vendors — Let your vendors know what you’re up to and what you need from them. If you have resistant vendors, help them understand that paperless invoices and electronic payments get them paid faster. Ottimate’s VendorPay network helps your vendor onboard to get them up and running.

7 Cutting Edge Capabilities To Look For in AP Automation Software

When shopping for your AP automation solution, pay attention to cutting-edge capabilities. As you move toward automating your club’s financial operation, make sure to get the most bang for your buck.

Here’s a checklist of “must-have” features:

1. Integrations

It’s important to choose an AP automation solution that integrates with your current systems. There’s no need to tear apart every system you already have in place that’s working well for your club. It’s wise to select a solution that can “drop in” to your current systems and keep your workflows fluid.

2. Quality of Invoice Digitization

A word to the wise, best-in-class invoice automation uses neural network-based AI for invoice digitization and OCR (Optical Character Recognition) because they’re able to process non-standard invoice formats, handwriting, and other less-than-pristine invoice papers that your standard, rules-based OCR would struggle to handle.

3. Invoice Automation

Paperless invoicing and automatic invoice approval will revolutionize your invoice process, reducing the time spent on invoicing by as much as 80%. Invoice automation includes integration with your accounting platforms, the ability to automatically route invoices for approval, and a vendor portal to electronically receive invoices.

4. Bill Pay

You must have the ability to pay vendors electronically (and remotely) within your AP automation platform for a true zero-touch process. It’s important that you’re able to pay on your own terms (like a partial invoice payment due to missing or damaged items) and through a variety of payment methods.

The ability to use virtual cards to pay vendors and earn back is future-thinking when it comes to your club’s bottom line. The Ottimate card lets you earn up to 1% cash back by simply paying your vendors.

5. Expense Management

Expense management is an essential feature of any platform. You must be able to track and analyze spending by department. The ability to get a detailed trail of every invoice and payment approval helps eliminate unapproved spending.

Virtual cards offer expense control, in-real-time expense tracking, and the pièce de résistance, cash back on all your transactions

6. Document Storage

Your AP platform must provide ample, secure document storage. You need to be able to quickly and easily access documents whenever necessary.

Say you’re at home over the weekend, working on monthly financial reports for the board and you come across an expense that needs clarification. You must be able to pull up the invoice in question remotely and get the clarification you need.

7. Automatic Line Mapping to GL Code

Automation means that processes should be automatic — that’s the ultimate benefit. A top-notch automation platform should have the ability to allow you to map invoice items to your chart of accounts once. From then on, those items should be coded correctly and AUTOMATICALLY to your GL.

AP Automation Will Revolutionize Your Private Club

Sloth-speed, manual AP processes should be a thing of the past — in most businesses, they already are. More and more private clubs are utilizing technology to bring their club up to date and boost efficiency and service. Shouldn’t yours too?

Accounts payable plays a critical role in maintaining the overall health of your club. By significantly improving the efficiency and effectiveness of your AP processes, not to mention autonomy, continuity, and CONSISTENCY.

You know how beneficial accounting tools can be for your country club, so don’t spend another day entrusting your business to the whims of fate. Instead, take control of your profit margins and invest in Ottimate, the right accounting tool for your country club.

Stay up to date on the latest news in AP automation and finance

Related